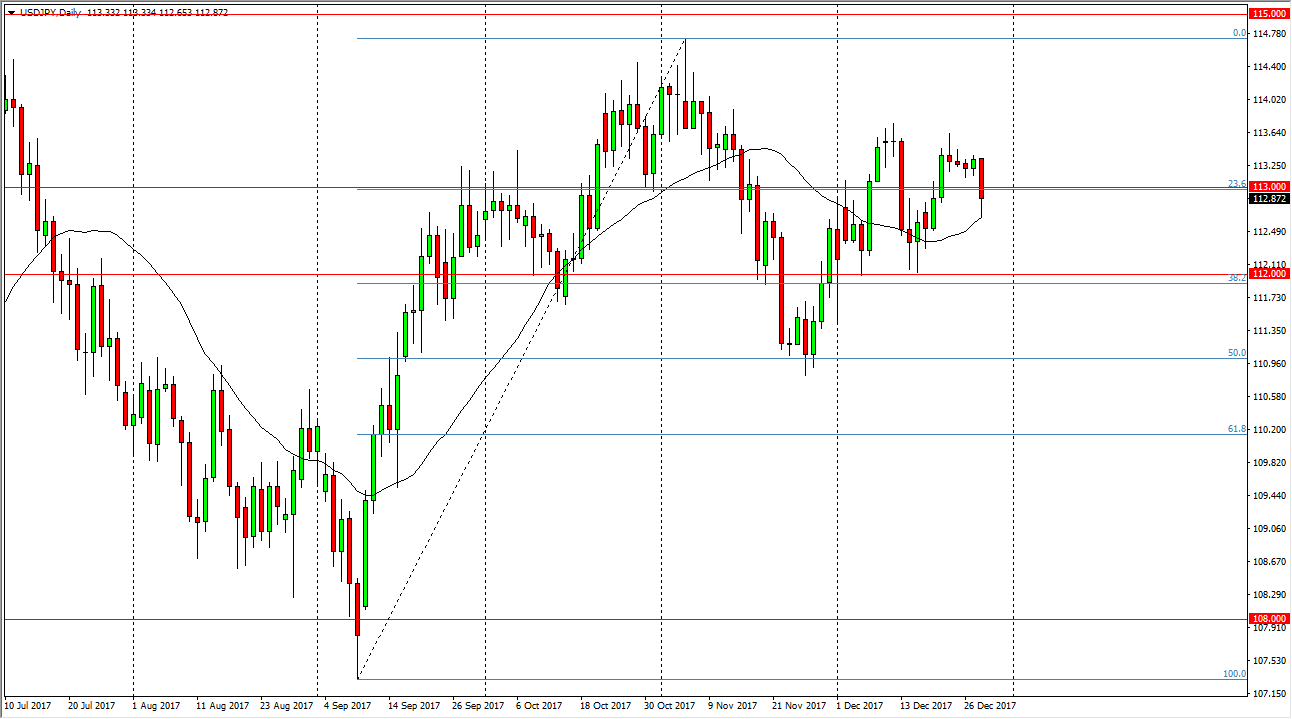

USD/JPY

The US dollar broke down significantly during the trading session on Thursday, slicing below the 113 level. We did bounce a bit though, and I think that if we can break above the 113 handle, the market may continue to go bit higher. However, if we were to break down below the bottom of the candle for the session on Thursday, I think we could probably drop towards the 112 level. With a lack of volume in the marketplace, it’s likely that we will see a bit of choppiness. At this point though, I am much more comfortable buying this market on a break to the upside, but more than likely will only do so after New Year’s Day, as the volume will pick up. This will be especially true after the jobs number comes out for December.

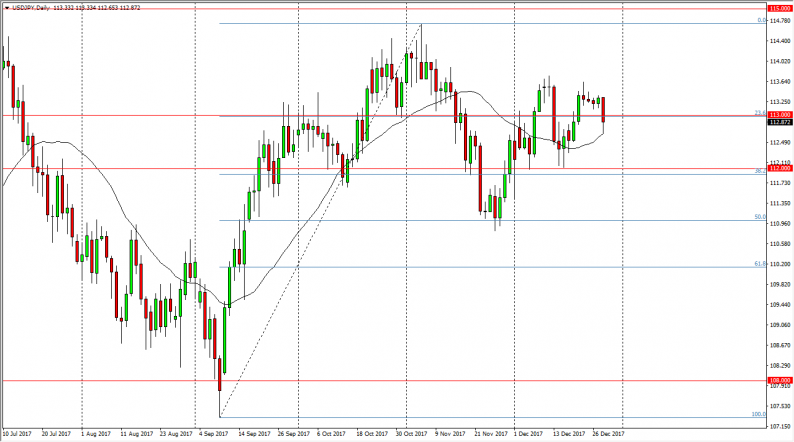

AUD/USD

The Australian dollar rallied a bit during the trading session on Friday, but again we are in fairly illiquid environments. I think that the market is eventually going to go towards the 0.80 level above, as it is a large, round, psychologically significant number, and it is of course a number that has been very important on longer-term charts. I maintain that a break above that level and if we can stay above there on perhaps a weekly chart, then it is a “buy-and-hold” market. This is only true if the gold market rallies and breaks out as well, with the $1300 level being an area of significant contention in that contract. Until then, it’s likely that pullbacks will be short-term buying opportunities, and I think that we will get a significant amount of volatility.

Leave A Comment