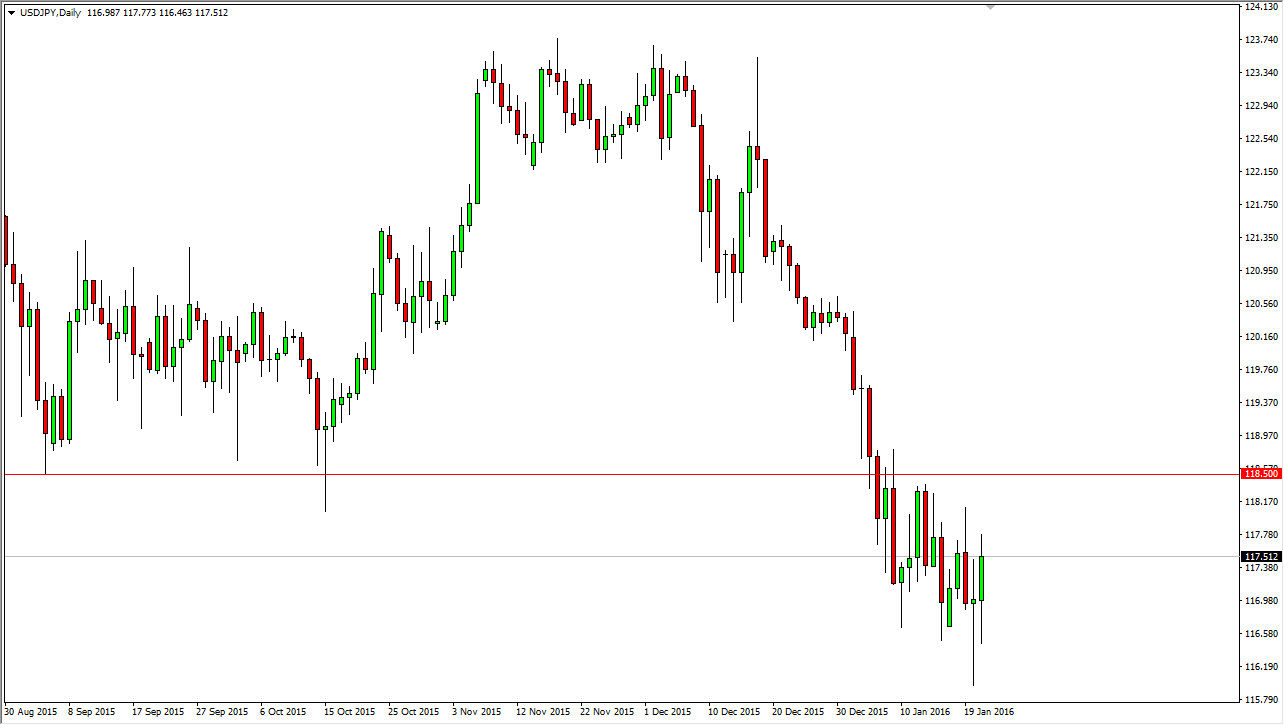

USD/JPY

The USD/JPY pair initially fell during the day on Thursday, but then bounced quite a bit towards the 117.80 level. Ultimately though, we pull back a little bit shows to me that there is a lot of volatility and indecision in this market at this moment. It simply does not have the confidence to go higher, and the key word here of course is “confident”, as the market is very sensitive to risk appetite around the world. I think if we can break above the 118.50 level the market will go much higher, but until then I have to think that the short-term sellers reenter this market again and again. I think that the 150 level below is essentially the “floor” in this market, but at this point in time I don’t know that we have enough bearish pressure to get down there either. This is going to be a tough market to trade over the next several sessions.

AUD/USD

The AUD/USD pair fell slightly during the day on Thursday in the beginning, and then turned around to show a very strong candle by the end of the day. We tested the 0.70 level above, which of course was resistive based upon the large, round, psychologically significant number. Ultimately, I believe that as long as we stay below the uptrend line above that we had broken down below we are still in a bearish market. After all, the Australian dollar is a proxy for the Chinese market, which of course is very negative at this point in time. Remember, Australia struggles when China struggles mainly because of the fact that the Australians supply most of the raw materials for Chinese construction.

A resistive candle above is exactly what I’m looking for in order to start selling, as it could signal that the market is turning back around and reaching towards US dollar again. Ultimately, I still believe that we have further to go to the downside.

Leave A Comment