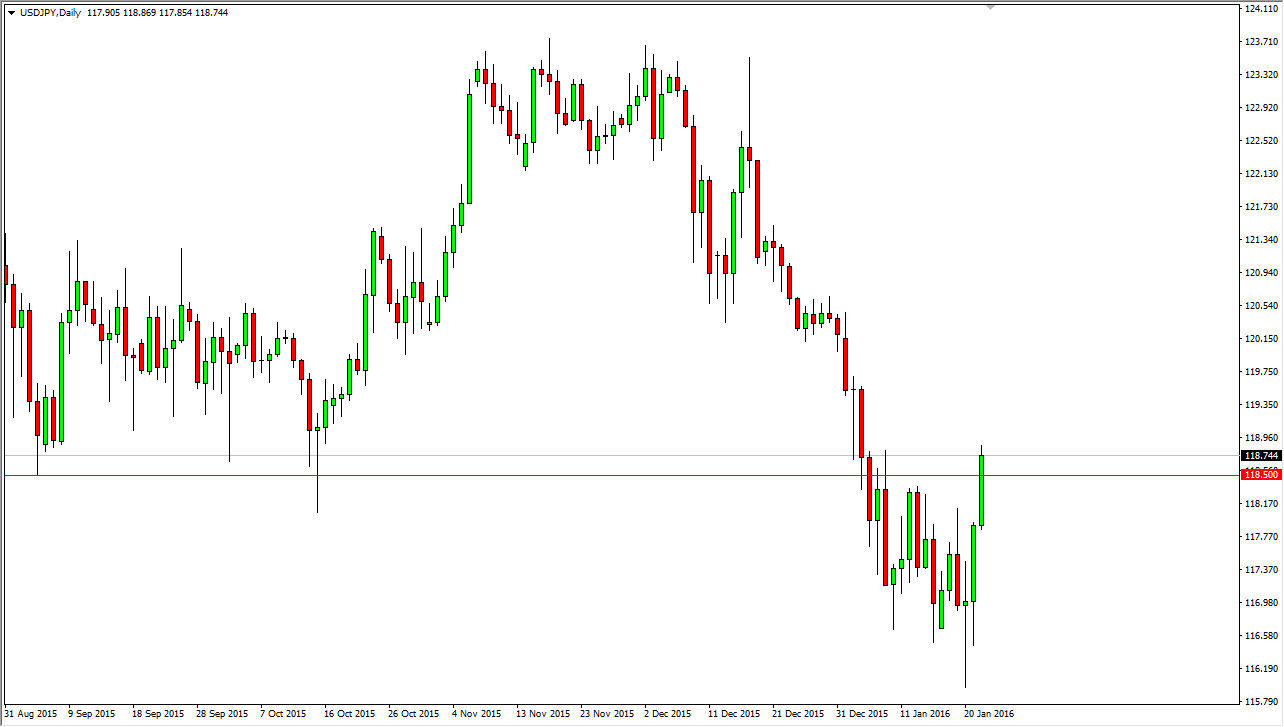

USD/JPY

The USD/JPY pair broke higher during the course of the day on Friday finally clearing above the 118.50 handle. Because of this, I think that we are going to see a significant amount of bullish pressure going forward, and a break above the highs from the Friday session is reason enough for me to start going long of a market that certainly could offer value at this point in time.

It is not lost on me that the stock markets around the world formed a nice-looking hammer for the week, and that normally means that risk appetite will be back on. As we rise in the stock markets, risk appetite will transfer from there to this currency pair as the US dollar should continue to gain. On a break above the 119 level, I would not be surprise at all to see this market go to 120.50, and then eventually 123.50 given enough time.

AUD/USD

In a completely opposite frame of mind, the AUD/USD pair tried to rally during the course of the day on Friday, but failed and ended up turning back around to form a perfect shooting star. The shooting star is right at the 0.70 level, and that of course is a large, round, psychologically significant number. Because of this, I believe that if we can break down below the bottom of the candle for the session on Friday, we could very well find ourselves falling back towards the 0.68 region.

Even if we break above the top of the shooting star, I’m not completely convinced. I think that the previous uptrend line should now act as resistance as per usual, and therefore that should give us an opportunity to sell this market at an even higher level as we build up enough momentum to go even lower. Is not until we break above the uptrend line that I would consider going long.

Leave A Comment