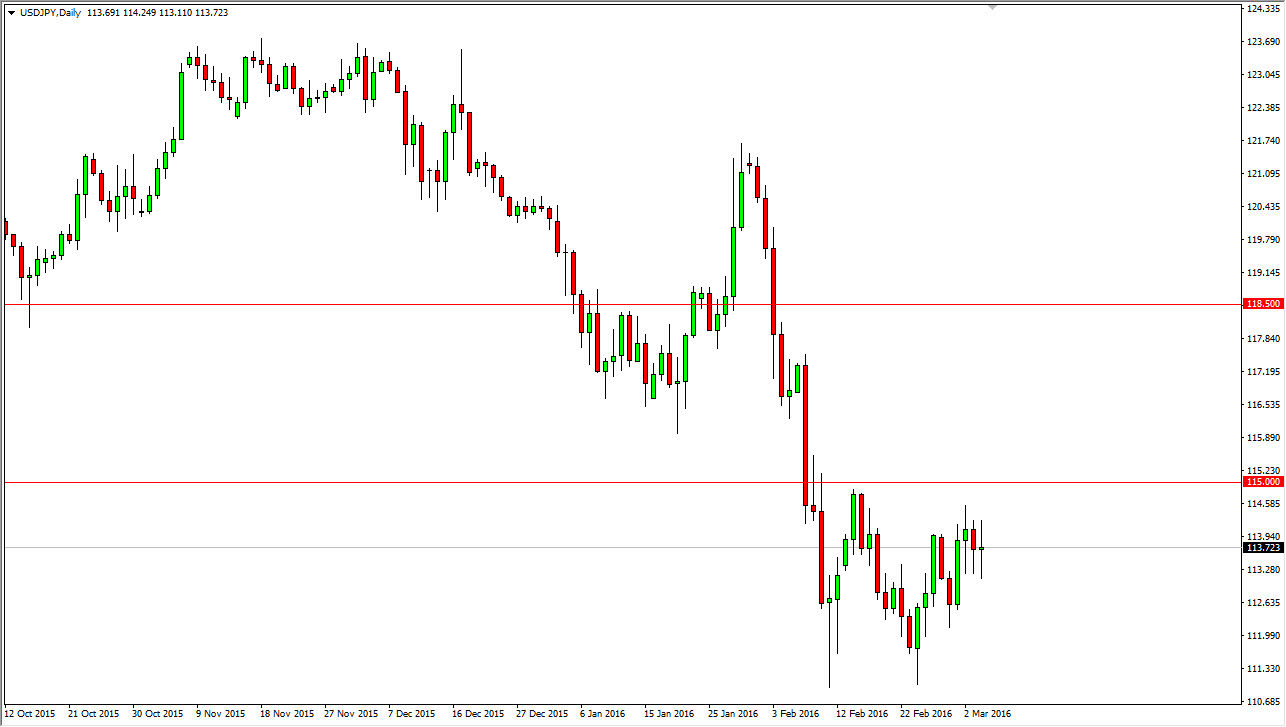

USD/JPY

The USD/JPY pair went back and forth during the session on Friday, as we continue to grind away just below the 115 level. That being the case, I believe that we will continue to go back and forth, and as a result this is going to be a very difficult market to get involved in. The market is very sensitive to risk appetite in general, and of course there are a lot of moving pieces out there and the global stock markets will continue to be very volatile. With this, it’s very likely that there isn’t going to be much in the way of longer-term trades at this point, at least until we break above the aforementioned 115 handle. As far selling is concerned, we could do so if we can break down below the bottom of the range for the last couple of sessions, but more than likely we will find a lot of support at the 112 handle.

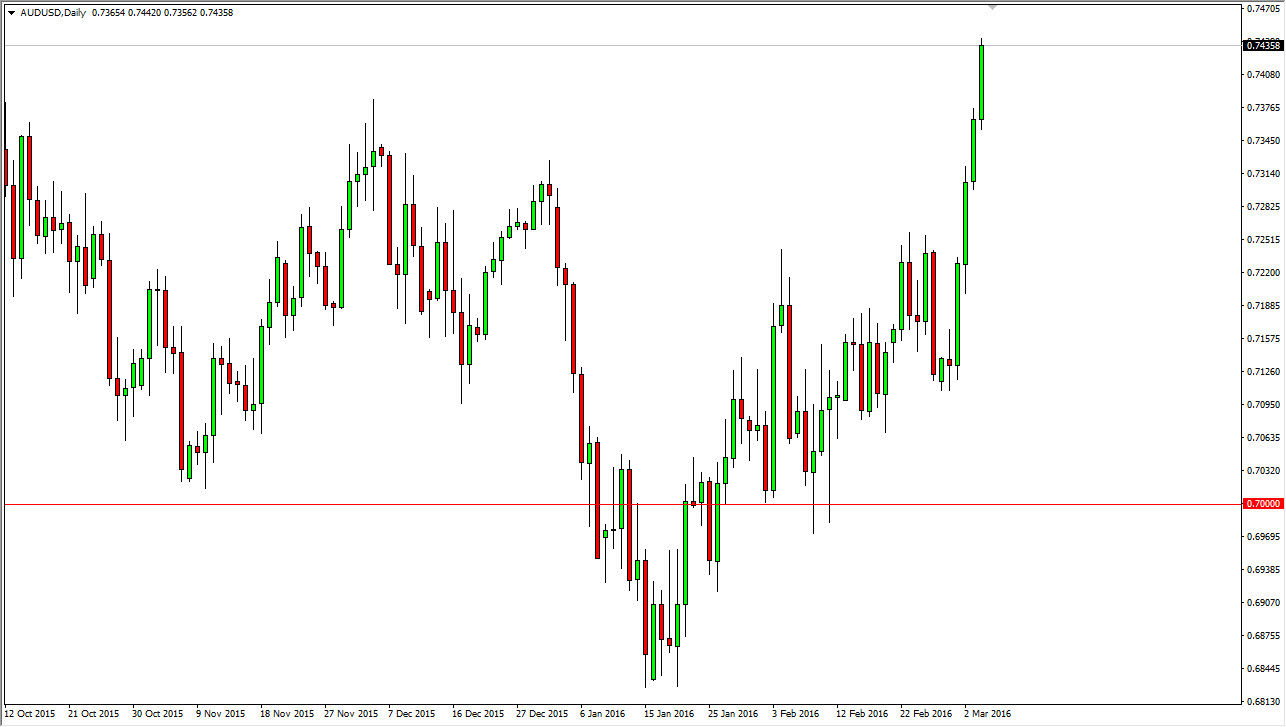

AUD/USD

The AUD/USD pair broke higher during the course of the session on Friday, for the forth session in a row. Because of this, it’s very likely that the market is going to continue to go much higher, but we are a bit overbought at this point. If we pullback from here, I anticipate that we will see supportive candles below that we can start buying. With this, I am simply waiting for a bit of exhaustion and negativity to take advantage of what I believe is the changing of the longer-term trend in the Australian dollar. At this point, pay attention to the gold markets, as they seem to be breaking out quite a bit and it’s only a matter of time before that pulls the value of the curency to higher levels as the two are so highly correlated.

Leave A Comment