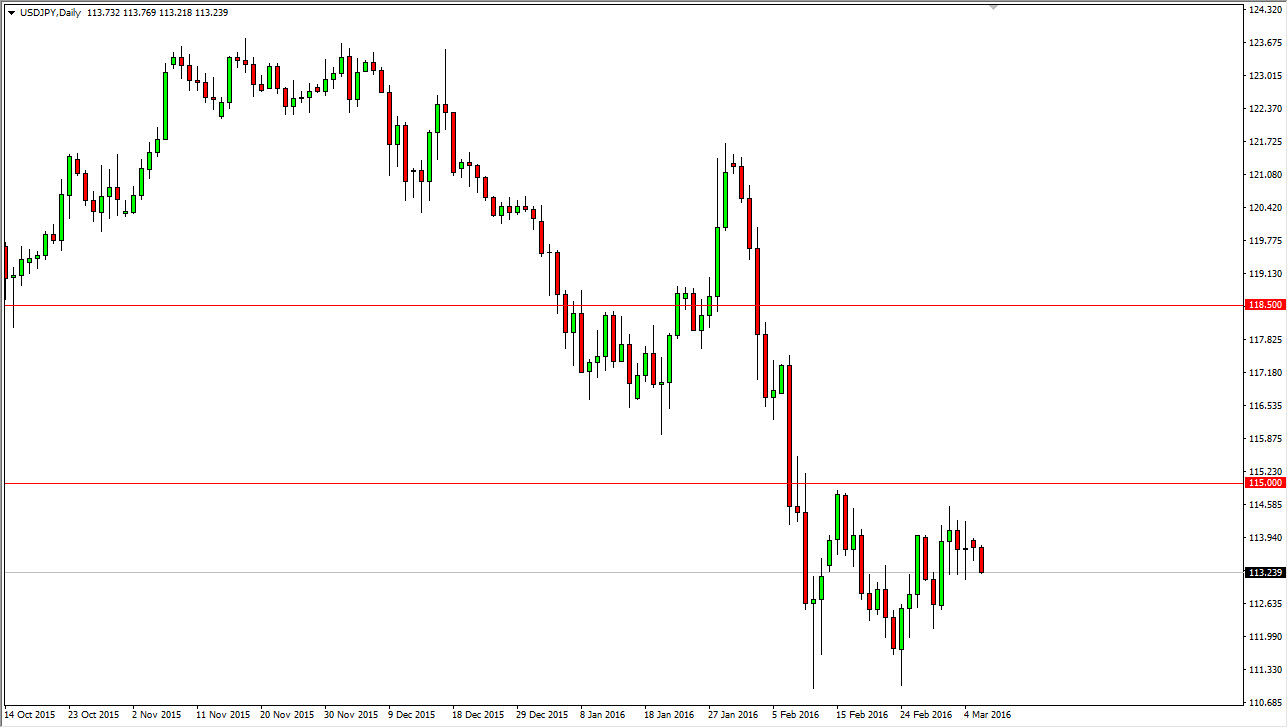

USD/JPY

The USD/JPY pair fell slightly during the day on Monday, testing the 113 level. This is a market that has been consolidating in a fairly tight range lately, so I think it is going to continue to be a bit difficult to trade for any real length of time, so I’m not interested. However, I do recognize that the 115 level above is a massive barrier to keep the market down. If we can break above there, then the market would be easier to hold onto from a long position, so it’s essentially what I’m waiting for.

Even if we fall from here, I believe that there is enough support below at the 112 level to cause the market to bounce. Any supportive candle would be reason enough to buy down there. The market would then try to reach towards the 115 level again. I have no interest in shorting this market at this point.

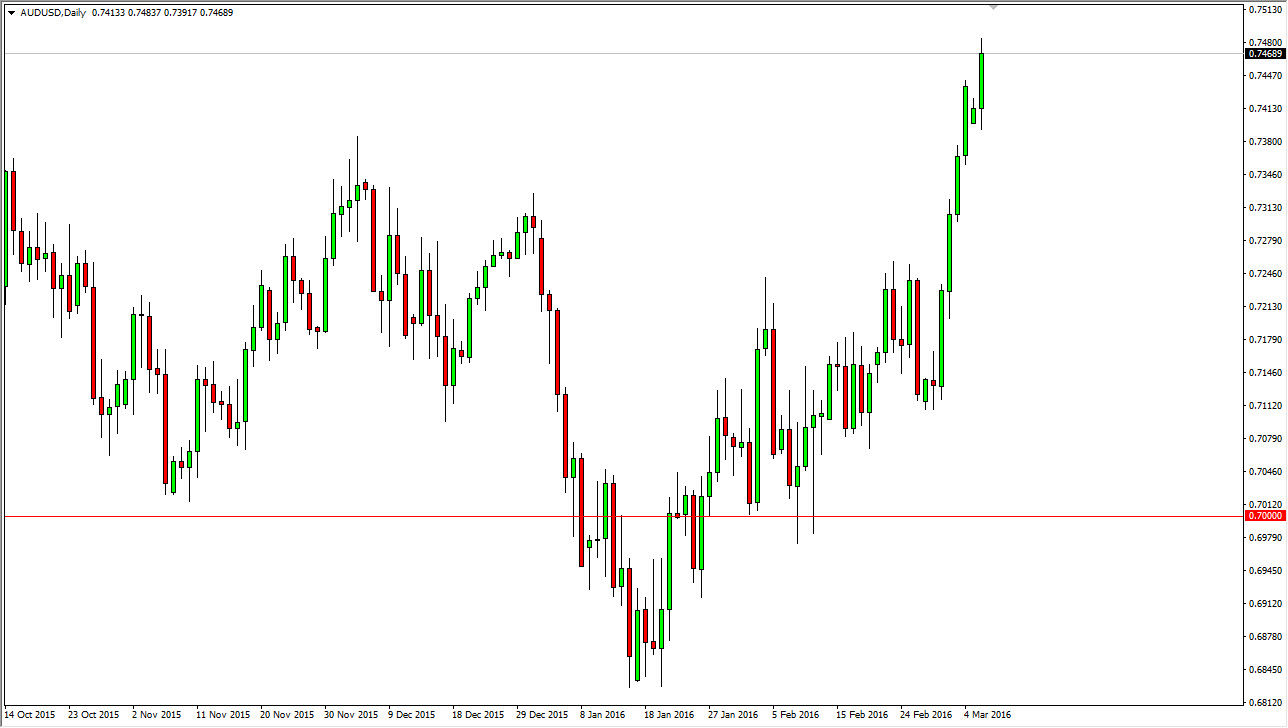

AUD/USD

The AUD/USD pair initially fell during the course of the day on Monday, but turned around at the 0.74 level to continue to strengthen, like we have seen for several sessions out. I believe that we are going to test the 0.75 level, and eventually break above there. However, we are a bit stretched at this point so it’s very likely that a pullback occurs. That pullback should offer value in the Australian dollar though, so at that point I more than willing to start buying.

Ultimately, you have to pay attention to the gold markets which look like they are going to rally from here, and if we do, we should see the Australian dollar in a fit as a result. With the gold markets looking so healthy, it’s very likely that we will continue to see strength in the Aussie, but right now we may need to build up enough momentum to finally make that move above the 0.75 level which could open the door to the 0.80 level.

Leave A Comment