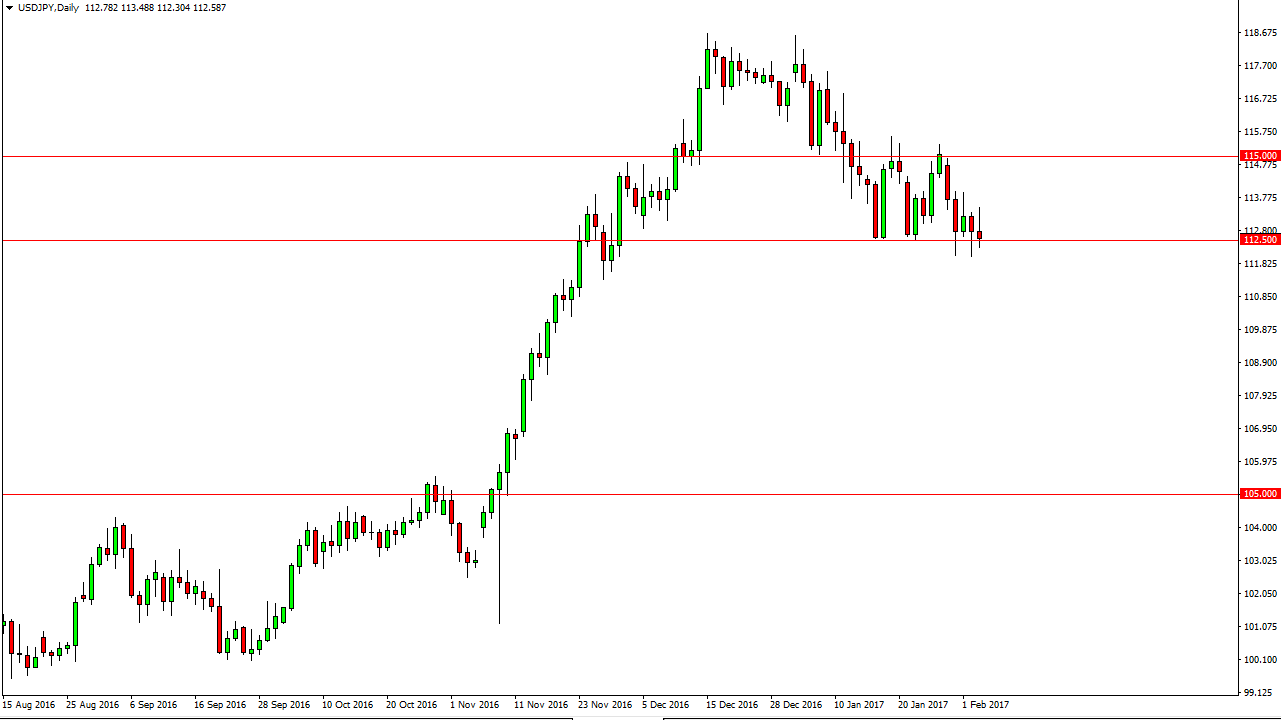

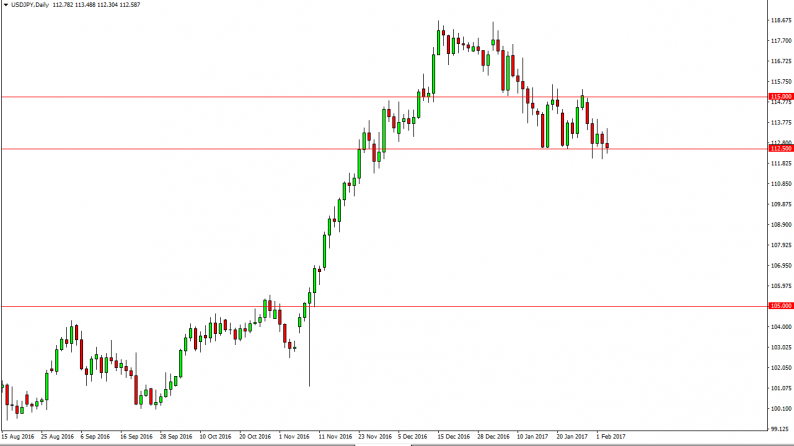

USD/JPY

The USD/JPY pair initially tried to rally on Friday, but as we went through the day, we ended up turning around and forming a bit of a shooting star. The shooting star sits on the 112.50 level, an area that has been massively supportive. A breakdown below there, and more importantly the hammer from the Thursday session, the market will then try to reach towards the 111.50 level. A breakdown below there should send this market looking for the 110 handle. A break above the top of the shooting star from the session on Friday would be a buying opportunity as the market within go looking for the resistance barrier at the 115 handle.

This pair will continue to offer quite a bit of volatility, and with this market, it looks as if although we have seen a significant pullback, the reality is that the uptrend is still very much intact. Part of the reason that the Japanese yen has been a little bit stronger is that the Bank of Japan did not add to quantitative easing, and the bond buybacks that they got involved in wasn’t that impressive.

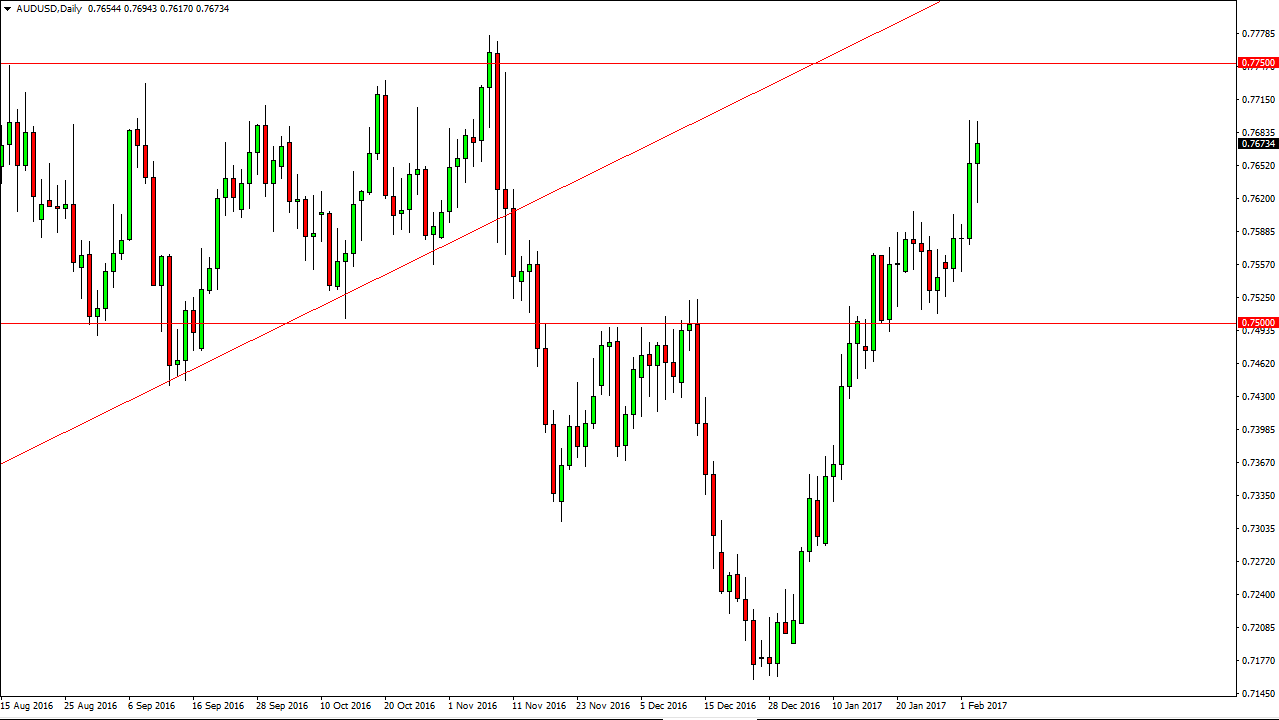

AUD/USD

The US dollar had a volatile session as we typically do during the Nonfarm Payroll Fridays. With this being the case, it’s not much of a surprise that we have seen so much choppiness. Ultimately, this is a market that will probably reach towards the 0.7750 level above, which should continue to be resistance going forward. Pay attention to the gold markets, they have a massive amount of influence on the Australian dollar itself. I believe that the 0.76 level below should be supportive, as it was once resistive. I believe that support runs all the way down to the 0.74 level, with the 0.75 level being the epicenter of all of that buying pressure. Because of this, I’m not even thinking about selling.

Leave A Comment