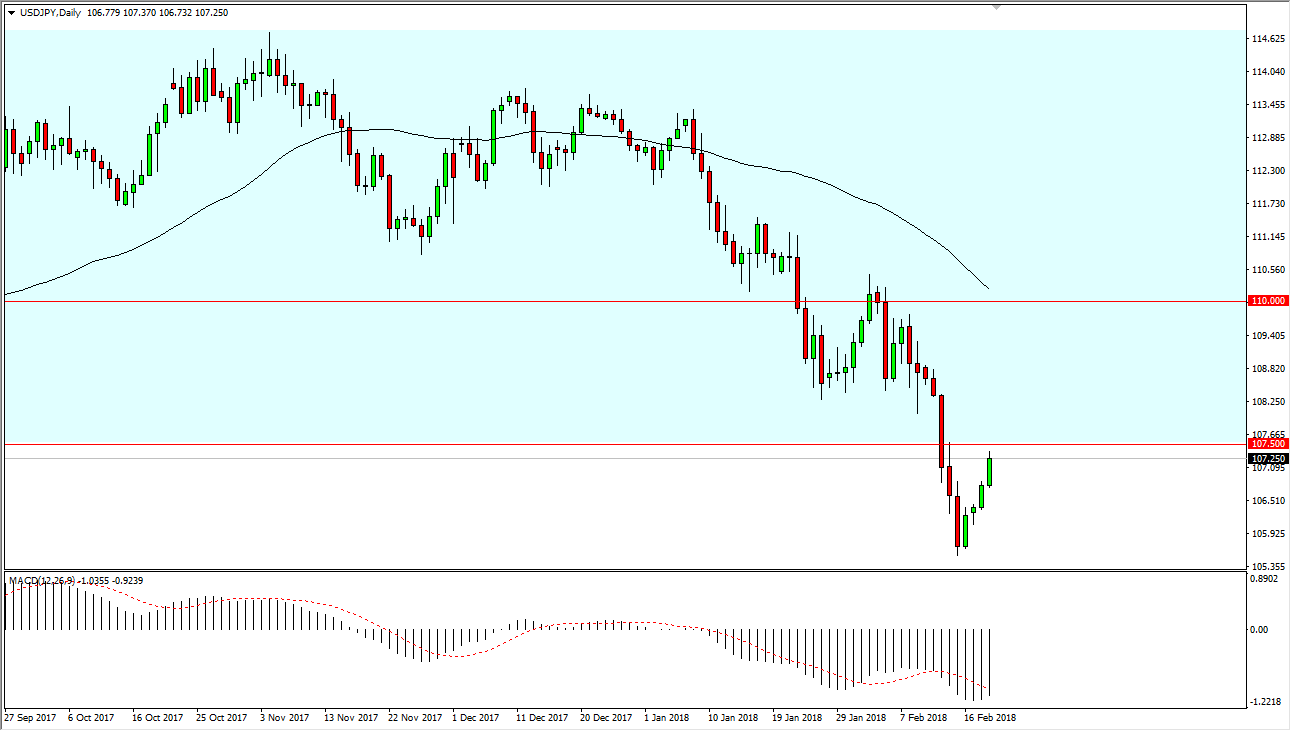

USD/JPY

The US dollar rallied against the Japanese yen on Tuesday as traders came back to work in the United States. The 107.50 level above has been resistance already, as it was significant support on longer-term charts going back a while. Because of this, I think that we will probably see sellers step into this market place, and perhaps start selling again. However, if we do break above the 108 handle, then I think we will probably make the grind higher towards the 110 level above which should be massively important.

Remember that this pair is somewhat risk sensitive, so pay attention to the stock markets. If they rally, typically this pair will as well, but if there’s a general US dollar selloff like we have seen as of late, that won’t matter much. Treasury markets have been a skittish place to be for those who are looking to hold greenbacks, so be advised of that.

AUD/USD

The Australian dollar fell rather hard during the day on Tuesday, breaking the back of a hammer from Monday. The hammer was a very bullish sign, but even more bearish is the fact that we broke down below the bottom of it. Now that we had cleared the 0.790 level, and the hammer, I think it’s only a matter of time before we dip even lower. The 0.70 level makes a significant support barrier based upon the large, round, psychologically significant number and of course the 50% Fibonacci retracement level that’s right around that level also.

I think that the market is going to continue to bang around in this general vicinity, as we need to build up enough momentum to break above the 0.80 level above for a significant move higher. At this point, I don’t want to short this pair, I am simply waiting for a bounce to take advantage of.

Leave A Comment