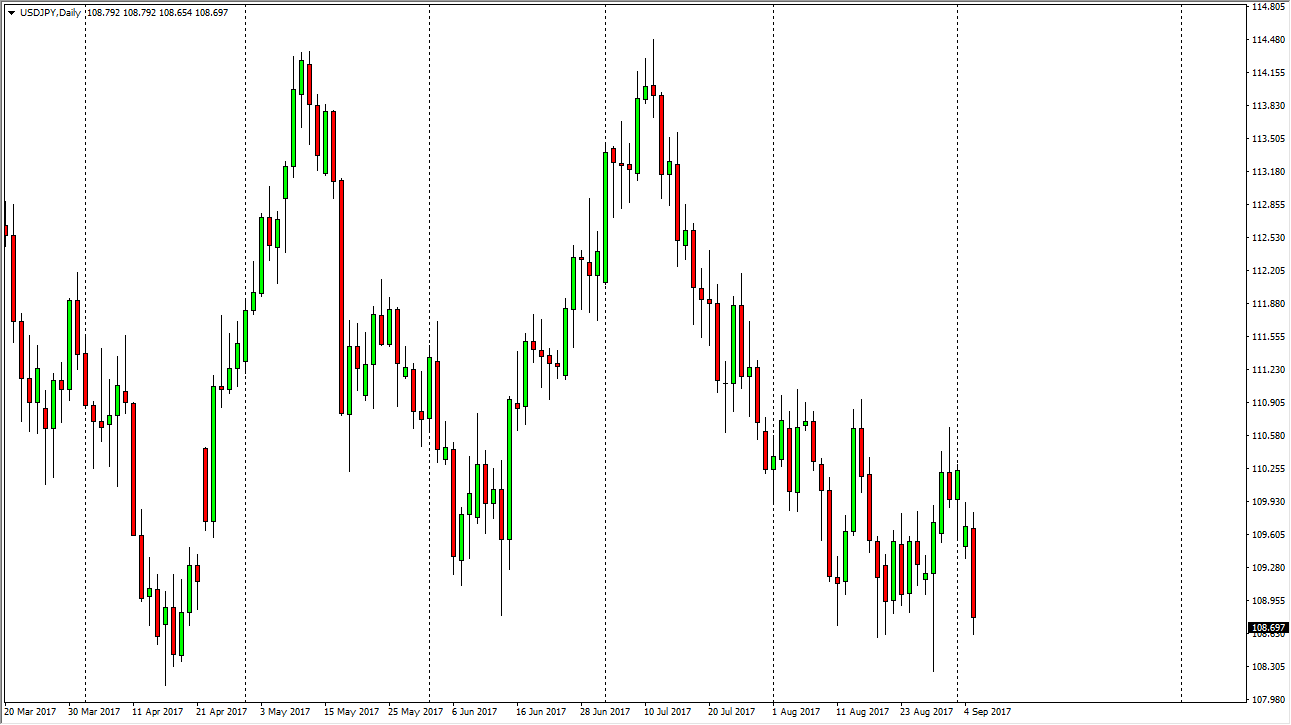

USD/JPY

The US dollar fell significantly against the Japanese yen, as we continue to see volatility overall. I think that there is a significant amount of support at the 108.50 level though, and it is the bottom of a larger consolidation area. That being said, if we break down below that level, and then I think the market will probably go down to the 105 handle. That is a major level, and I think a breakdown to that level could be rather quickly achieved. It is a market that should continue to attract a lot of attention, especially as the North Koreans continue to rock the markets. If we do rally from here though, I think the 111 level above is resistance, and a move above there would send this market much higher, perhaps to the 114.50 level.

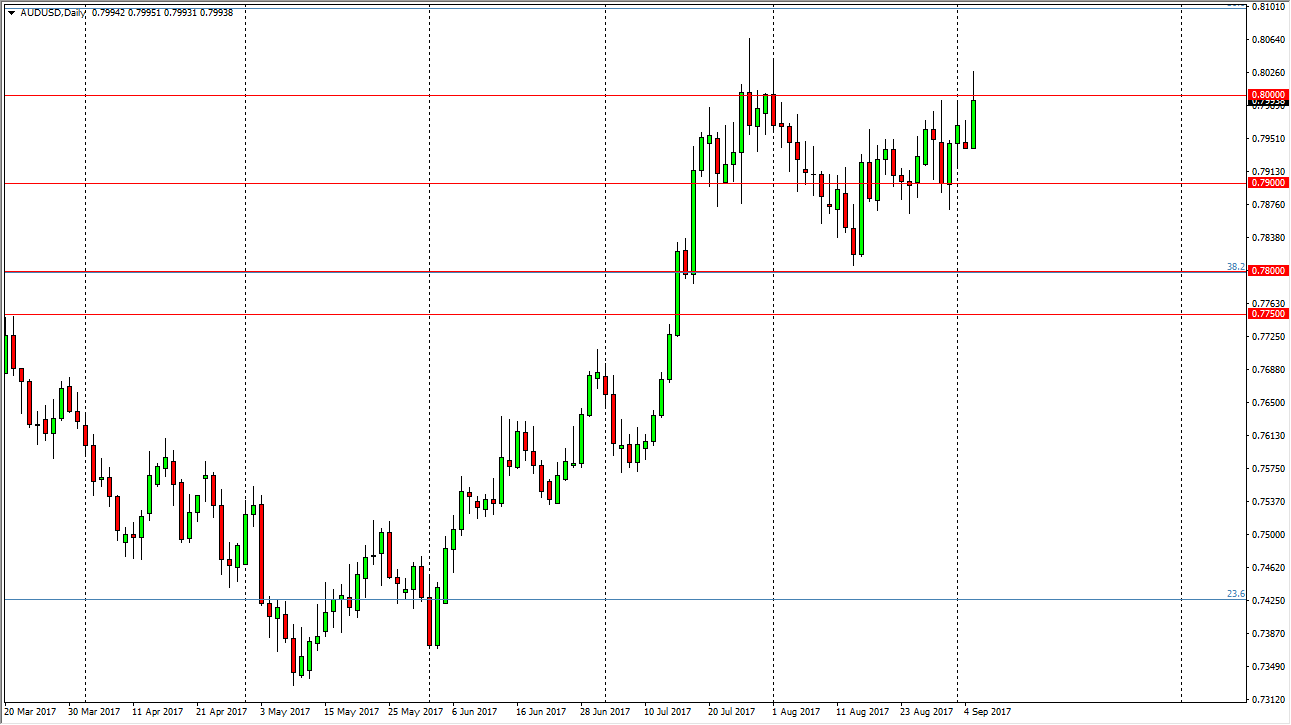

AUD/USD

The Australian dollar rallied significantly during the day, but the 0.80 level has offered resistance yet again. I think we will probably see a bit of a pullback from here, but quite frankly it’s not reason enough for me to sell as the market should start to see buyers underneath. I think the 0.79 level should be supportive, but if we break above the 0.80 level on a daily close, then I think the market goes much higher. Ultimately, this is a market that should continue to go higher if we get that moved, but you can see that the resistance has still been very stubborn. The market should continue to be very volatile in general, but I think that the buyers will eventually get involved and shoot this market to the upside. Once we break above the 0.80 level significantly, this is a market that is ready to go much higher on a longer-term basis.

Leave A Comment