USD/JPY

The USD/JPY pair initially tried to rally during the course of the session on Friday but turned back around as the 113 level was a bit too rich for the market. Because of this, we ended up forming a fairly negative candle and it looks like we’re going to go lower to try to test the bottom again. This makes a lot of sense, as this pair is very sensitive to risk appetite. There seems to be a lot of concern around the world right now, and as stock markets fall this pair will house well. Also, recently the Federal Reserve has had to admit that raising interest rates probably isn’t going to happen anytime soon, and with that it’s likely that the US dollar could continue to lose some strength against the Japanese yen as both central banks looks set to sit fairly still.

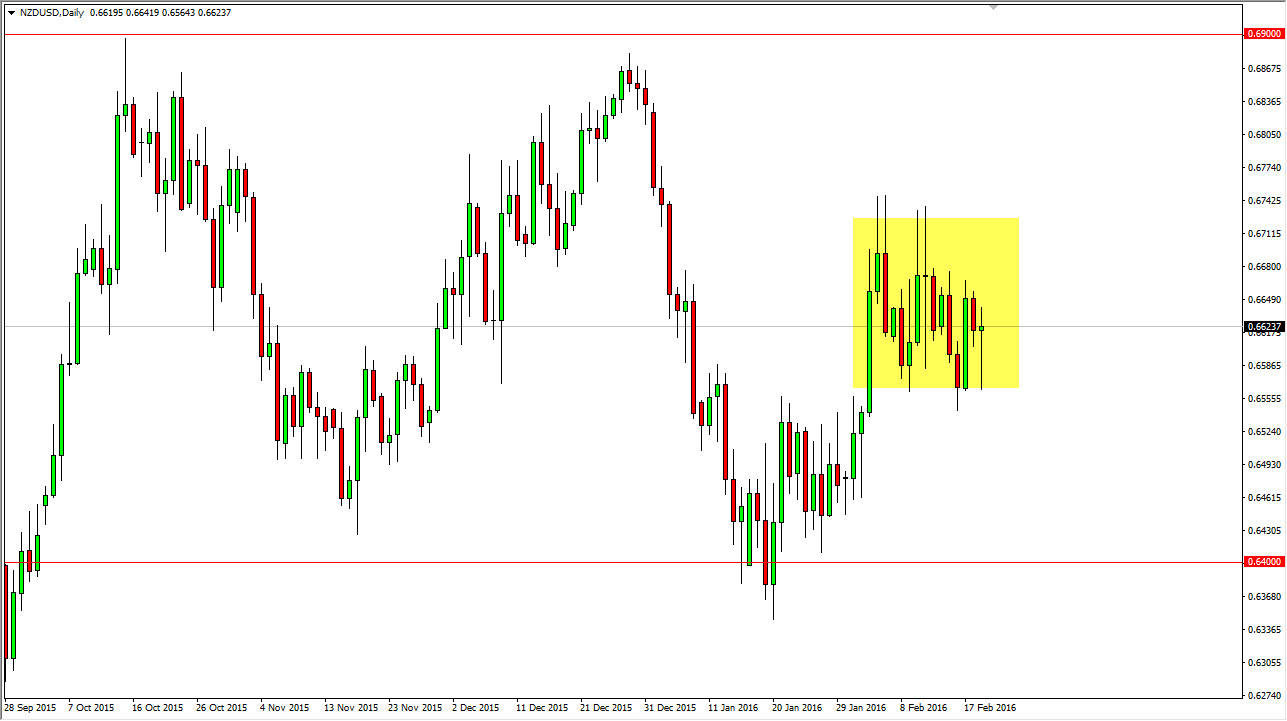

NZD/USD

The NZD/USD pair went back and forth during the course of the day on Friday, and ended up forming a bit of a hammer. The hammer of course is a rather supportive candle, and as a result I would not be surprised at all to see this market go higher. If it does, I don’t expect any type of break of the resistance above which I see at the 0.6750 level. At that we are simply going to continue to go back and forth as the commodity markets are extraordinarily volatile, and of course are somewhat directionless that point in time.

I think that short-term traders will be attracted to this market because we had such a well-defined trading range, which I also see the bottom at the 0.65 handle. At this moment though, we are essentially in the center of this area so although it looks like we’re going higher, it’s not necessarily the optimal place to place a trade. Because of this, I’m going to sit on the sidelines and perhaps wait for some type of pullback in order to start buying.

Leave A Comment