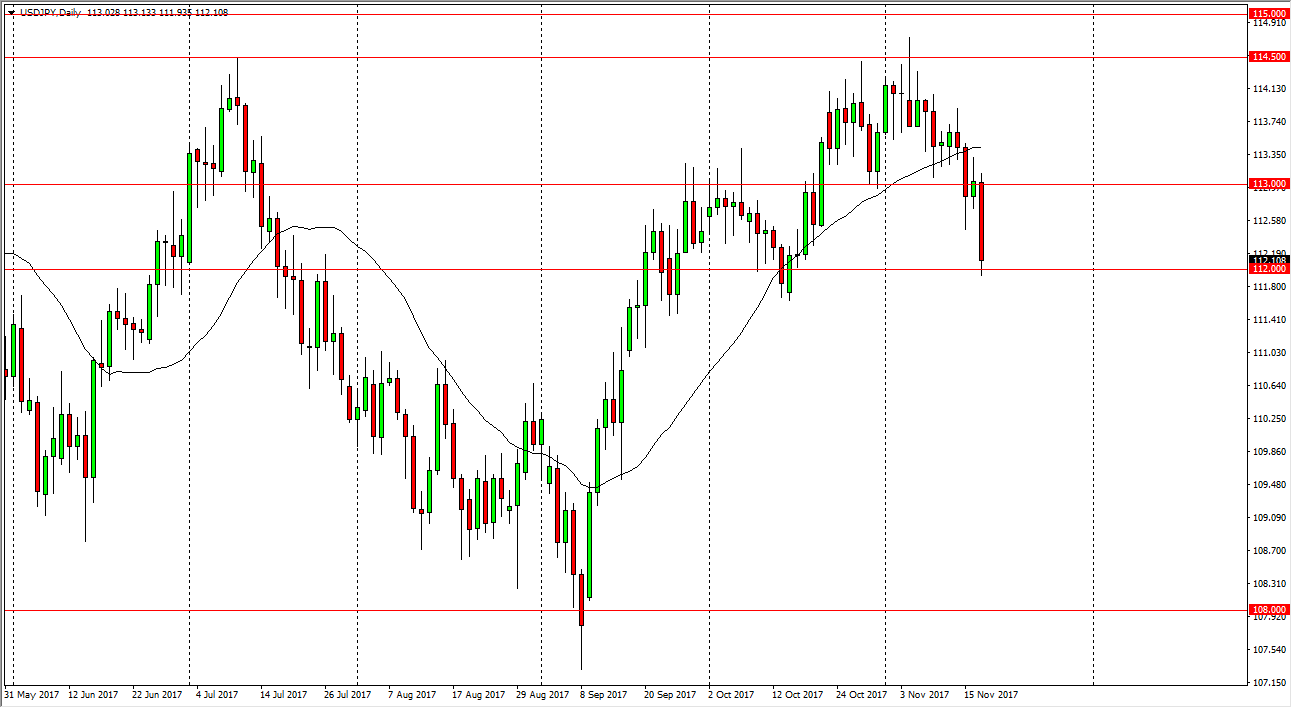

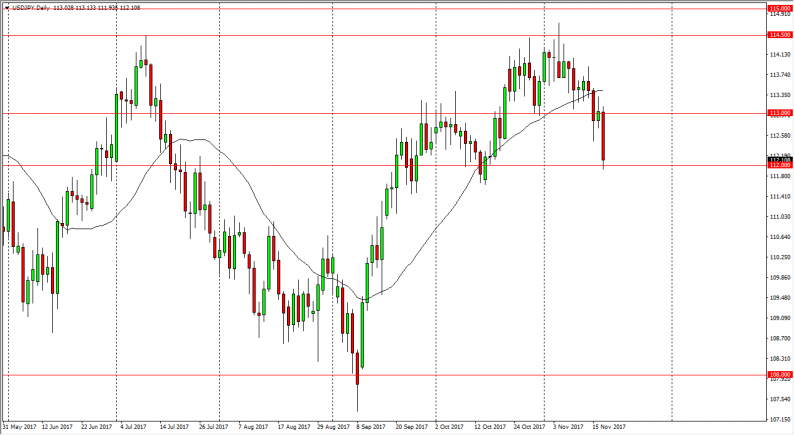

USD/JPY

The US dollar tried to rally against the Japanese yen initially, breaking above the 113 handle. However, we rolled over to form a very negative candle, slicing down towards the 112 level. It looks likely that the market is paying quite a bit of attention to the U.S. Congress, and whether it can pass a tax reform bill. Because it has not yet, the US dollar is starting to pay the price. The 112 level is very important, and if we can break down below there, the market should continue to go much lower, perhaps down to the 108 handle. The market looks likely to follow Congress, and because of this, I think if we break down below the bottom of the range for the day, the market probably reaches down to 108, where there should be a massive amount of bullish pressure. Alternately, if we bounce from here, and more importantly, break above the 113 level, we should then go to the 114.50 level after that.

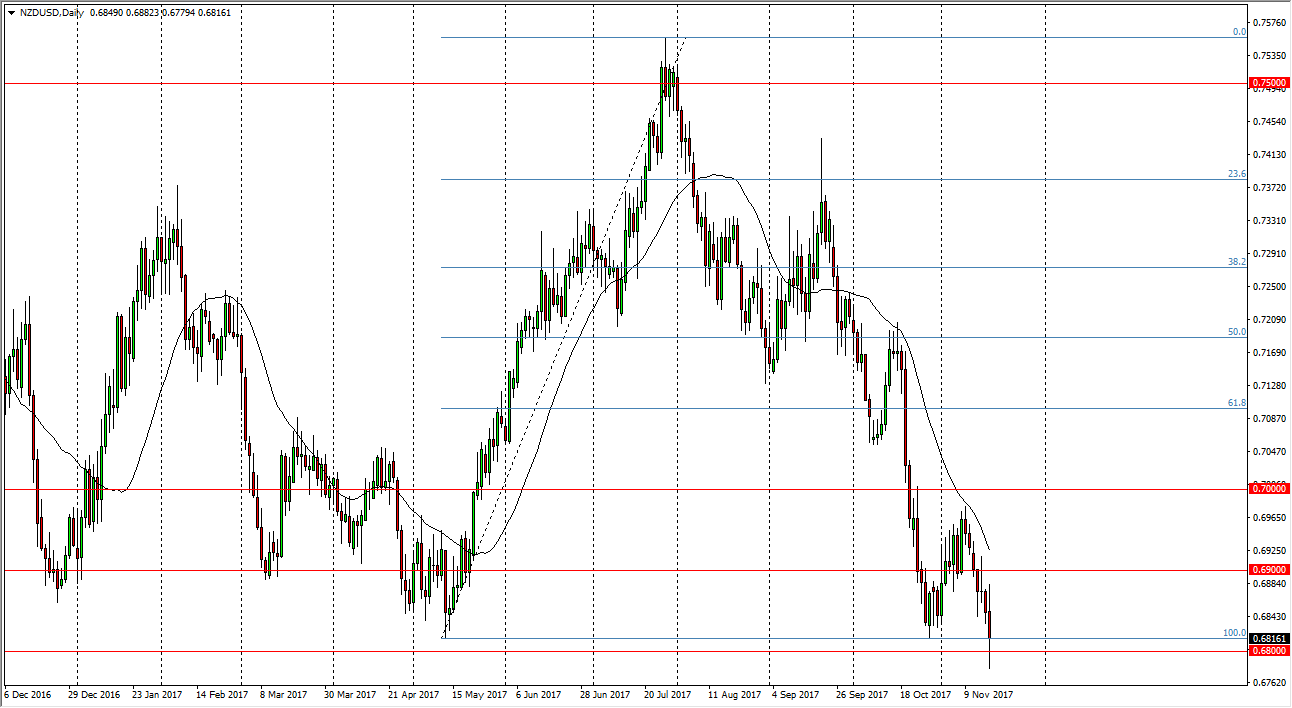

NZD/USD

The New Zealand dollar was very volatile during the trading session on Friday, as we continue to dance around the 0.68 handle. That’s an area that has been important in the past, and should be important in the future. If we break down below the bottom of the range for Friday, the market should break down towards the 0.65 level after that. Alternately, if we break above the top of the candle for the day, we could go as high as 0.70, but I would be surprised if we rallied above there. Ultimately, this is a market that I think continues to see bearish pressure though, as the New Zealand dollar is highly sensitive to risk appetite in general.

Leave A Comment