Video length: 00:06:08

The US Dollar continues to firm up (DXY, US DOLLAR) thanks to December rate hike probabilities nudging higher the past few days, from near 63% at the end of last week to approximately 70% today. In turn, we’ve seen pairs like EUR/USD and GBP/USD maintain their bearish technical bias, continuing to follow their respective daily 8-EMAs lower.

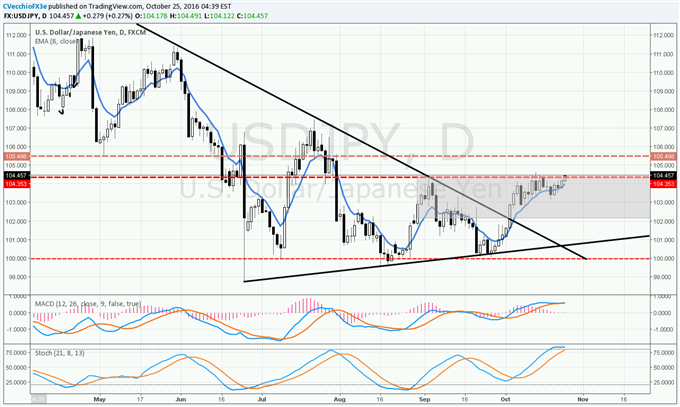

However, neither EUR/USD nor GBP/USD are of much interest today, relatively speaking; the resilience of AUD/USD and the potential breakout in USD/JPY are more pertinent indicators for the general ‘risk’ tone of the market. By these points of view, ‘risk’ looks to be fairly steady and could potential flip into a violent ‘on’ mode in the near-future: AUD/USD is trading in a short-term inverted H&S pattern (bullish implications) while attempting to break through the trendline from the January 2015 high; and USD/JPY is attempting to pivot through the early-September swing high near ¥104.35.

Chart 1: USD/JPY Daily Chart (March 2016 to October 2016)

USD/JPY’s attempt at a turn higher, alongside AUD/USD resilience, seemingly points to a situation where risk appetite could increase over the coming days. A look at US equity markets reveals equal potential for further constructive price action: the US S&P 500’s symmetrical triangle is holding above prior resistance after a recent breakout.

Leave A Comment