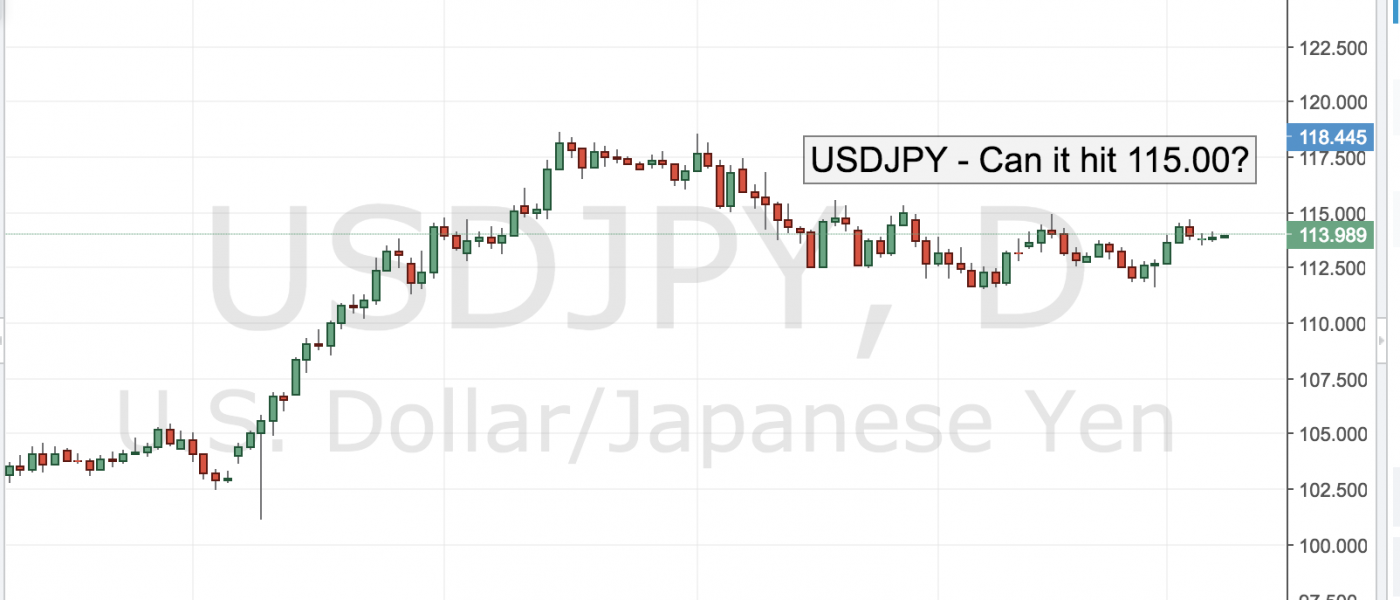

After weeks of listless trade, USD/JPY is showing some signs of life as it continues to hold on to the 114.00 figure. Although recent trading was decidedly muted the recent price action has all the marks of a dollar breakout.

The benchmark 10-year rate inched above the key 2.50% level helping to fuel pro-dollar flows after several days of very lackluster action. The currency market may be finally responding to a more hawkish Fed that has consistently signaled that it is on a path to hike rates 3 rather than 2 times this year.

Expectations for a Fed hike in March have ratcheted up considerably with Fed funds futures now assigning a higher that 50% chance of an increase. Still, the dollar rally remained within the recent boundaries of the range. If the US labor data, starting with ADP proves to be supportive the greenback will still need to take out the key levels at 115.00 USD/JPY to confirm that this breakout is real.

Leave A Comment