Strength can be seen in the Yen, as strong PMI Manufacturing data in Japan may suggest a strengthening in their large Export sector. Yield curves have flattened on US Treasuries, causing some allocation of funds out of US Treasuries and perhaps into other asset classes, that may be outside of USA and thus, some selling of USD’s and into foreign asset markets.

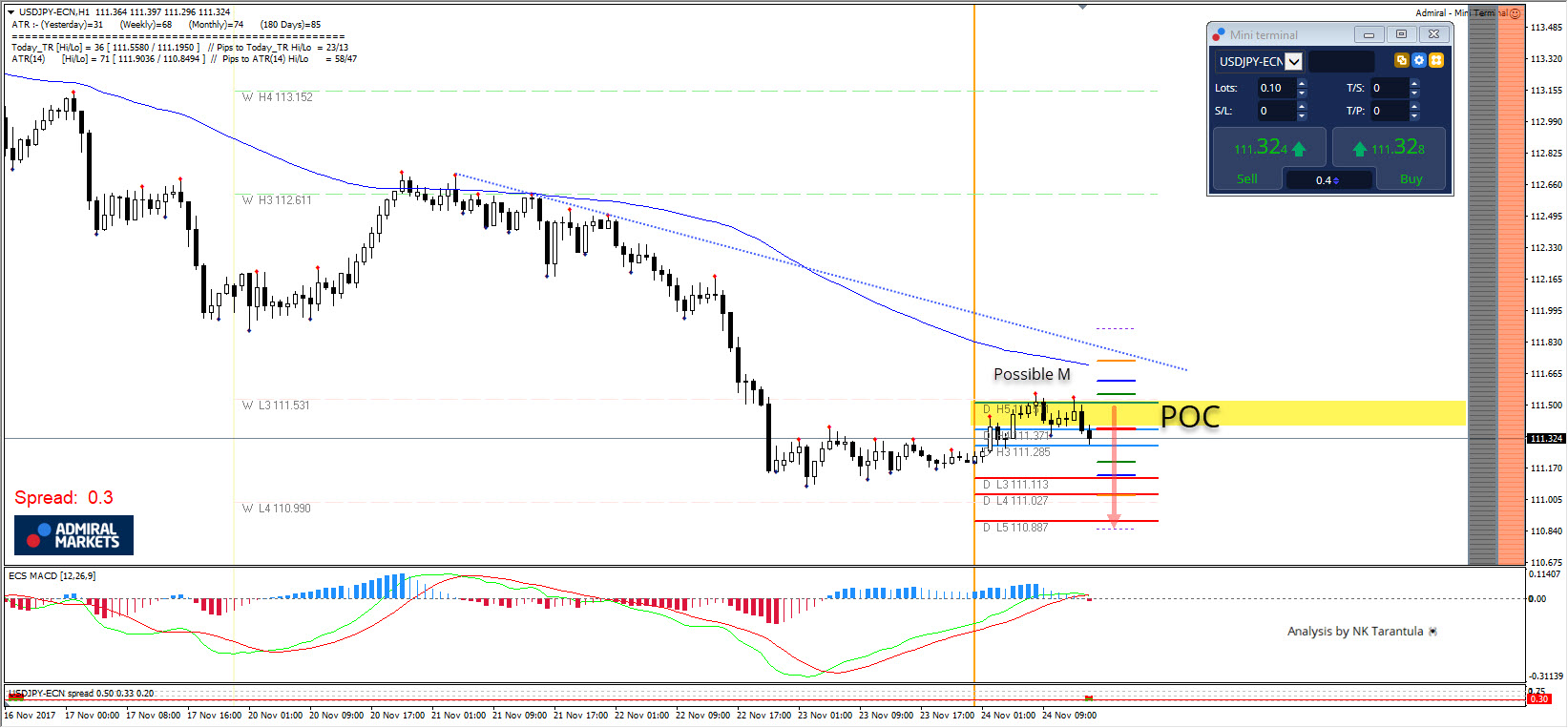

As I already showed yesterday on the USD/JPY, the price went up hitting my target (see the live entry I made on the webinar) and at this point, it is rejecting fro the POC that is strong due to W L3 and D H5 resistance. 111-35-50 is the zone and as long as 111.80 holds the target is 110.85. Watch for possible M pattern that might signify the continuation.

W L3 – Weekly Camarilla Pivot (Weekly Interim Support)

W H3 – Weekly Camarilla Pivot (Weekly Interim Resistance)

W H4 – Weekly Camarilla Pivot (Strong Weekly Resistance)

D H4 – Daily Camarilla Pivot (Very Strong Daily Resistance)

D L3 – Daily Camarilla Pivot (Daily Support)

D L4 – Daily H4 Camarilla (Very Strong Daily Support)

POC – Point Of Confluence (The zone where we expect the price to react aka entry zone).

Leave A Comment