FX Talking Points:

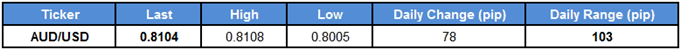

AUD/USD remains bid going into the end of January, with the pair at risk of extending the advance from late last year as Australia’s Consumer Price Index (CPI) is expected to show a pickup in both the headline and core rate of inflation.

The updates to Australia CPI may keep AUD/USD afloat as the reading is projected to increase to an annualized 2.0% from 1.8% in the third-quarter of 2017, and signs of stronger price growth may encourage the Reserve Bank of Australia (RBA) to gradually alter the outlook for monetary policy especially as ‘forward-looking indicators of labour demand suggested employment growth would be somewhat above average over the next few quarters.’

Even though Governor Philip Lowe & Co. are widely expected to retain the wait-and-see approach at its next meeting on February 6, a batch of hawkish rhetoric may fuel the broader shift in AUD/USD behavior as the central bank shows a greater willingness to start normalizing monetary policy.

AUD/USD Daily Chart

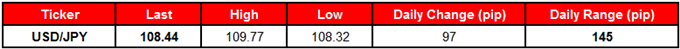

USD/JPY remains under pressure following the lackluster 4Q U.S. Gross Domestic Product (GDP) report, but the Federal Open Market Committee’s (FOMC) first meeting for 2018 may sway the near-term outlook for the dollar-yen exchange rate as the central bank appears to be on course to further normalize monetary policy over the coming months.

Leave A Comment