![]()

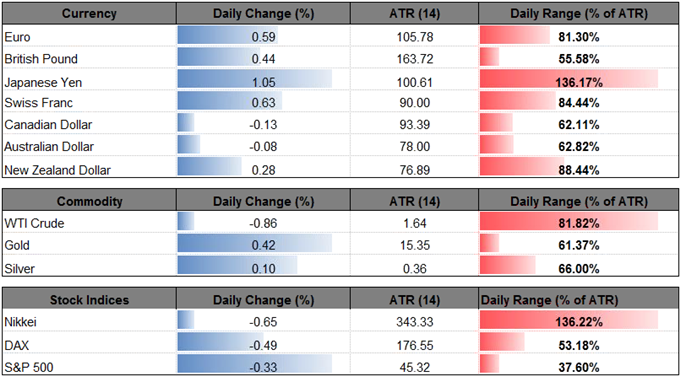

USD/JPY remains under pressure even as Federal Reserve officials endorse a hawkish outlook for monetary policy, and the dollar-yen exchange rate stands at risk for further losses as the bearish momentum appears to be gathering pace.

Fresh remarks from Cleveland Fed President Loretta Mester have failed to produce a meaningful reaction even though the 2018-voting member on the Federal Open Market Committee (FOMC) insists that ‘if economic conditions evolve as expected, we’ll need to make some further increases in interest rates this year and next year, at a pace similar to last year’s.’ The comments suggest the FOMC is on course to implement three rate-hikes in 2018, but the updates to the U.S. Consumer Price Index (CPI) may rattle expectations for a move in March as both the headline and core rate of inflation are anticipated to slowdown in January.

At the same time, a separate report is projected to show U.S. Retail Sales increasing a marginal 0.2% following a 0.4% expansion in December, and a batch of lackluster data prints may drag on the greenback as it dampens the outlook for growth and inflation.

In turn, it may be only a matter of time before dollar-yen tests the 2017-low (107.32), with the downside targets on the radar especially as the Relative Strength Index (RSI) extends the bearish formation from late last year and flirts with oversold territory.

USD/JPY Daily Chart

Leave A Comment