The U.S. dollar fails to benefit from the Non-Farm Payrolls (NFP) report as the updates fall short of market expectations, with USD/JPY at risk for a larger pullback as a bearish series takes shape.

Looking ahead, attention turns to the Reserve Bank of New Zealand (RBNZ) interest rate decision on tap for May 10 as Governor Adrian Orr hosts his first meeting, and a mere attempt to buy more time may drag on NZD/USD as the central bank appears to be on track to retain the record-low cash rate throughout 2018.

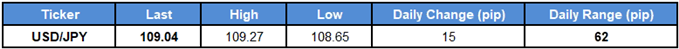

USD/JPY CONTINUES TO CARVE BEARISH SERIES FOLLOWING DISMAL NON-FARM PAYROLLS (NFP) REPORT

USD/JPY slips to a fresh weekly-low (108.65) as updates to the U.S. Non-Farm Payrolls (NFP) report dampen bets for four Fed rate-hikes in 2018, and the pair may continue to give back the advance from the previous month as it carves a series of lower highs & lows.

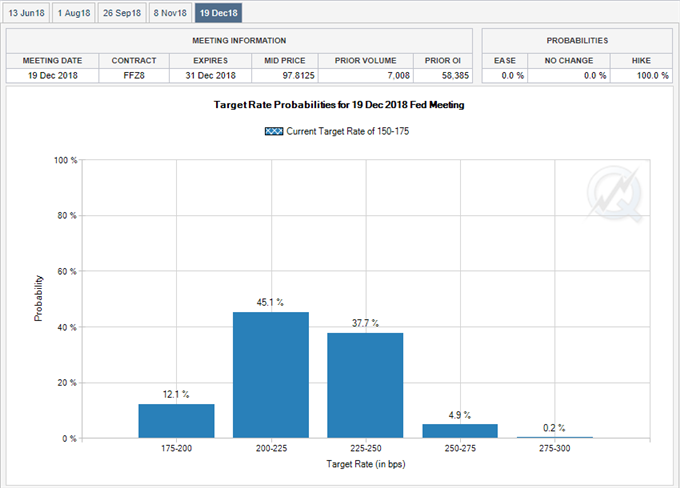

Beyond the 164K expansion in job growth, the downtick in the Labor Force Participation rate paired with the unexpected slowdown in Average Hourly Earnings dampens the Federal Open Market Committee’s (FOMC) scope to expand the hiking-cycle as the developments highlight ongoing slack in the real economy.

As a result, the Fed may tolerate above-target price growth for the foreseeable future as the central bank pledges to ‘carefully monitor actual and expected inflation developments relative to its symmetric inflation goal,’ and Chairman Jerome Powell and Co. may continue to project a neutral Fed Funds rate of 2.75% to 3.00% as borrowing-costs are ‘likely to remain, for some time, below levels that are expected to prevail in the longer run.’

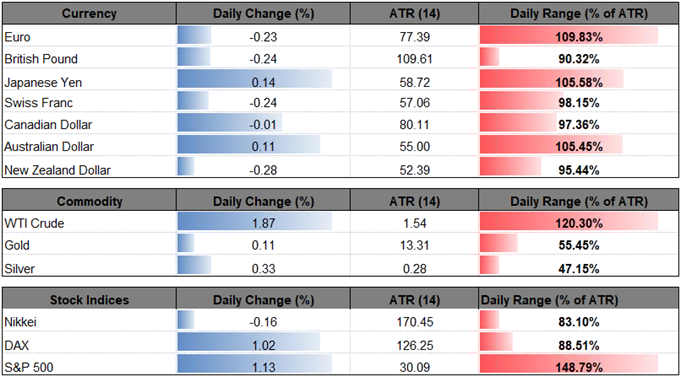

With that said, Fed Fund Futures may continue to reflect waning expectations for four rate-hikes in 2018, with the greenback at risk of exhibiting a more bearish behavior over the days ahead as U.S. Treasury Yields pullback from recent highs.

USD/JPY DAILY CHART

Leave A Comment