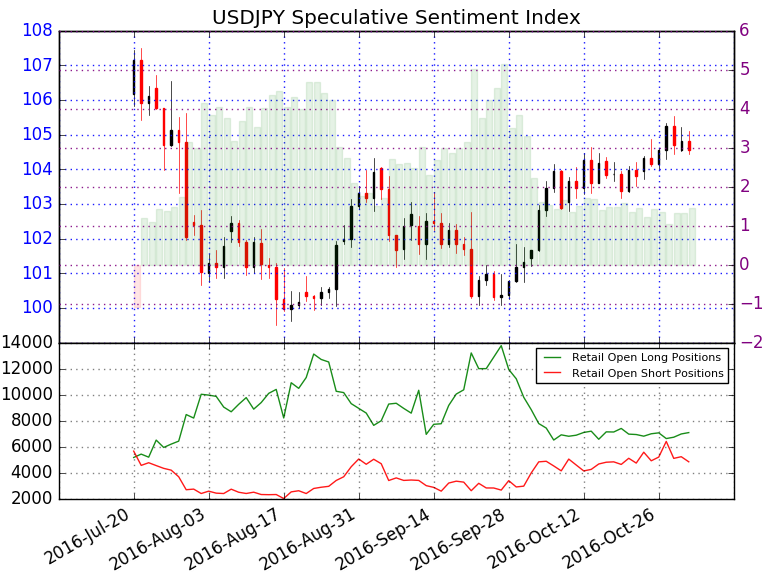

USD/JPY 120min

Chart Created Using TradingView

Technical Outlook: The USDJPY rally failed just ahead of the May lows at 105.55 last week with the pair coming under pressure today in U.S. trade. Heading into tomorrow’s FOMC interest rate decision, the near-term risk remains tilted to the downside while below confluence resistance at 104.86.

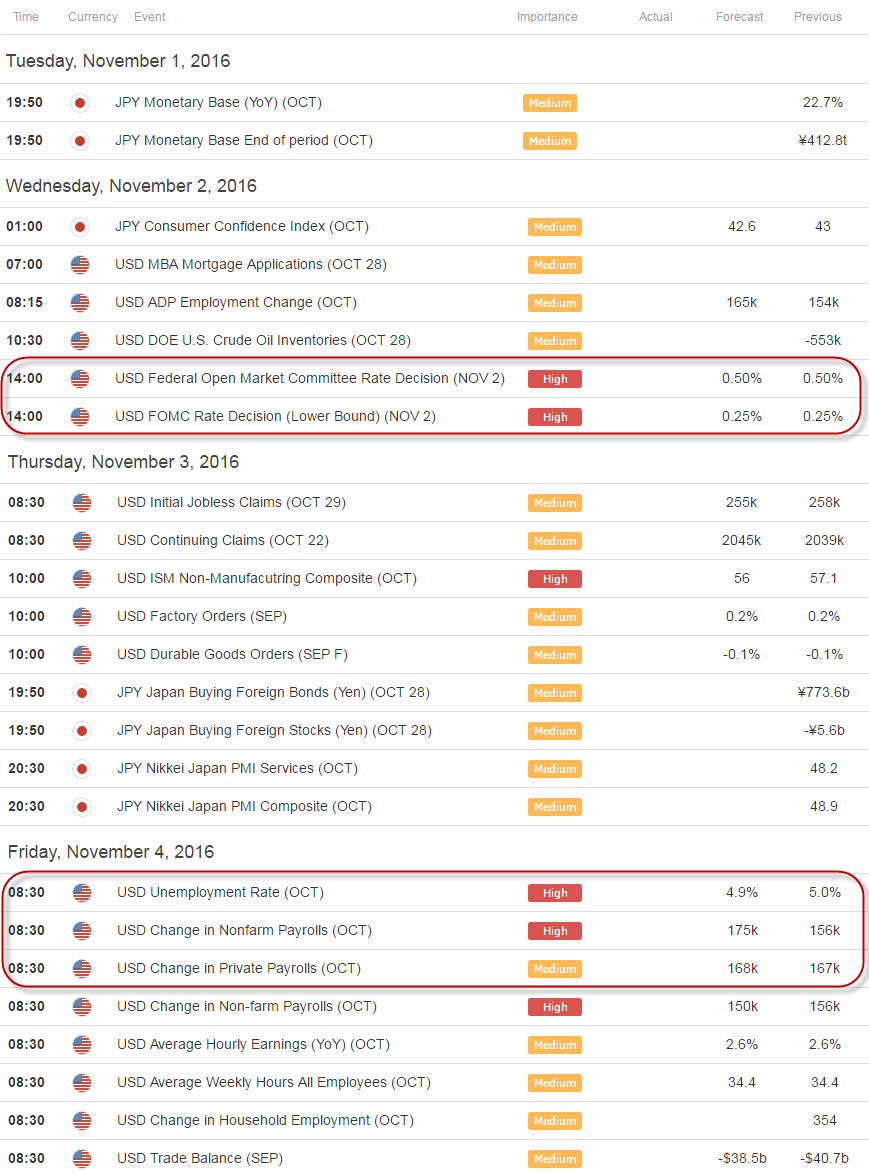

A newly identified pitchfork off the highs highlights near-term support at 104.16 backed by a more significant confluence at 103.45. A break below 102.81 would be needed to shift the broader focus back to the short-side of the pair (bullish invalidation & area of interest for near-term exhaustion / long-entries). From a trading standpoint, I’m looking to fade strength into structural support where the USDJPY may look to mount a more significant counter-offensive. Keep in mind the central bank is widely expected to stand pat on monetary policy this month with Fed Fund Futures still pricing in a nearly 72% chance for an interest rate hike in December.

Leave A Comment