CIBC is not alone, thinking the dollar’s fall was an overreaction. While the road to recovery may be hard, the team at Goldman Sachs sees the greenback rising:

Here is their view, courtesy of eFXnews:

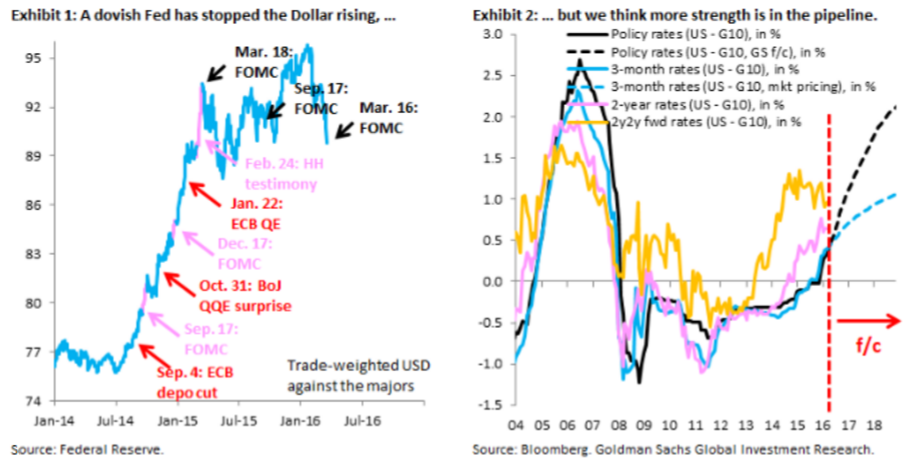

Over the past year, the Fed has repeatedly arrested the Dollar rise and this week’s FOMC, with the shift in rhetoric towards caution over external risks, marked another iteration.

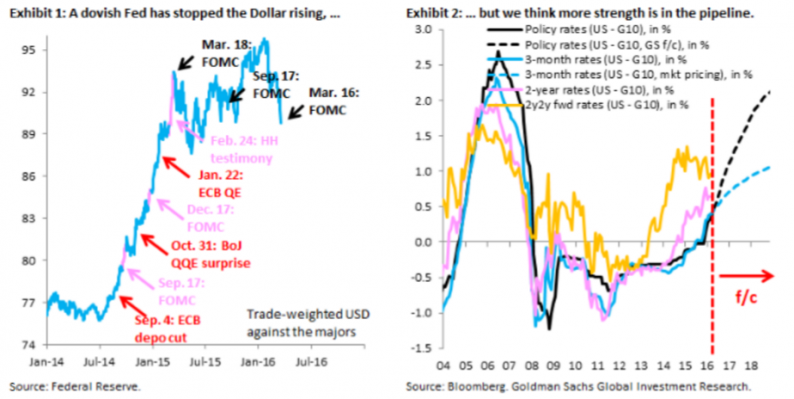

We have sympathy for the Fed’s dilemma. After all, BoJ and ECB easing led the Dollar to rise sharply in H2 2014, before US monetary policy normalization could even begin. For the Fed, this is a major headache because – if our expectation for Fed hikes is correct – USD could rise another 15 percent, i.e. underlying appreciation pressure is large. This might be why the Fed is modulating its message, for fear that sounding upbeat could trigger another sharp rise in the Dollar.

We make three points: (i) dovish shifts from the Fed over the past year have only been able to put the Dollar into a holding pattern, they have not reversed the 2014 rise; (ii) data will ultimately force the Fed’s hand, which is why our US economists have stuck with their call for three hikes this year; and (iii) the underlying case for the divergence trade is stronger, not weaker, given that a dovish Fed will spur US outperformance versus the Euro zone and Japan.

Going up is hard to do, but the Dollar will go up.

Leave A Comment