In his first testimony in front of Congress, Jerome Powell handles himself with aplomb, proving to be able stewart of the US monetary policy while handling the often inane questions from politicians with admirable restraint.

Although Mr. Powell offered no new insights into US monetary policy, he did state that he thought that the US economy has strengthened. That’s important because it suggests that Fed intends to follow its target of three rate hikes this year. Unlike Ms. Yellen, Mr. Powell appears to be more determined to normalize policy and less affected by day to day data to take him off the course.

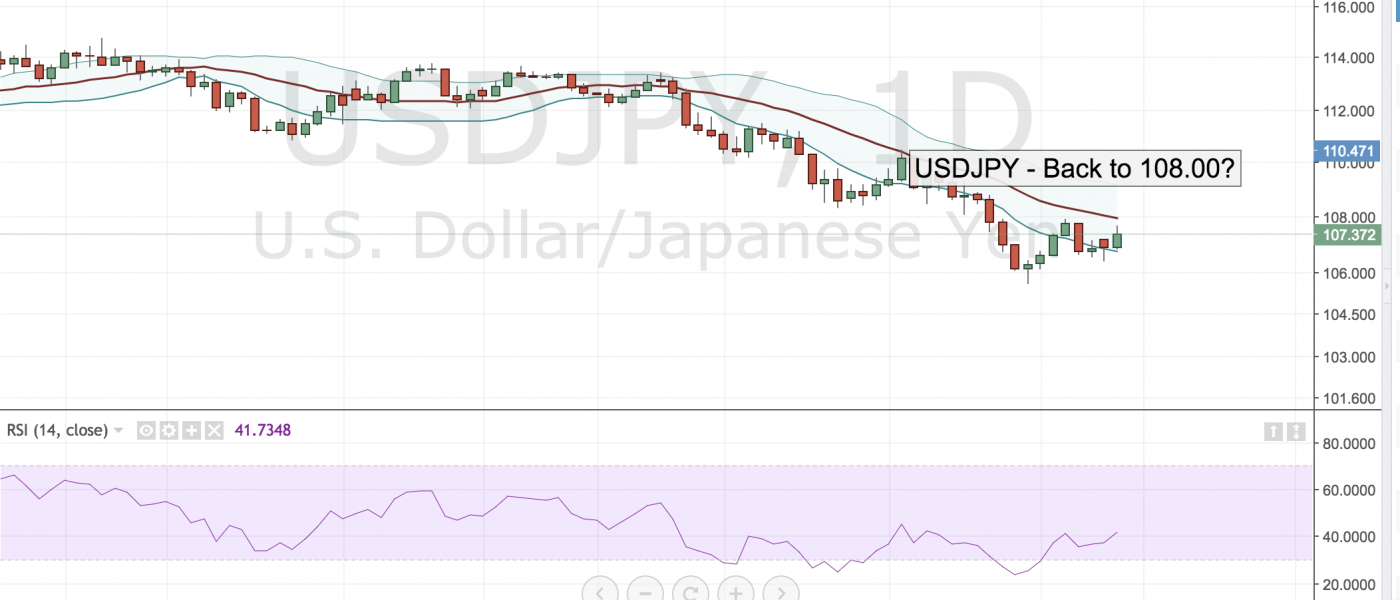

Such perceptible increase in hawkishness is likely to make its way felt in the fixed income market with US yields rising back above the 2.90% level. If bond yields move back to recent highs of 2.94%, USDJPY which has been consolidating for the past few weeks, may finally break above the 108.00 level for good and begin to rise towards the key 110.00 level.

Leave A Comment