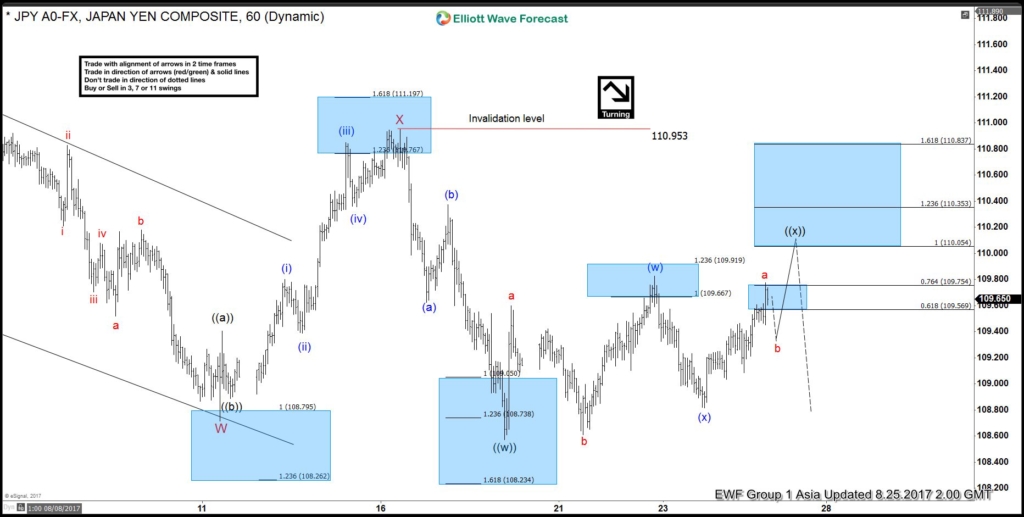

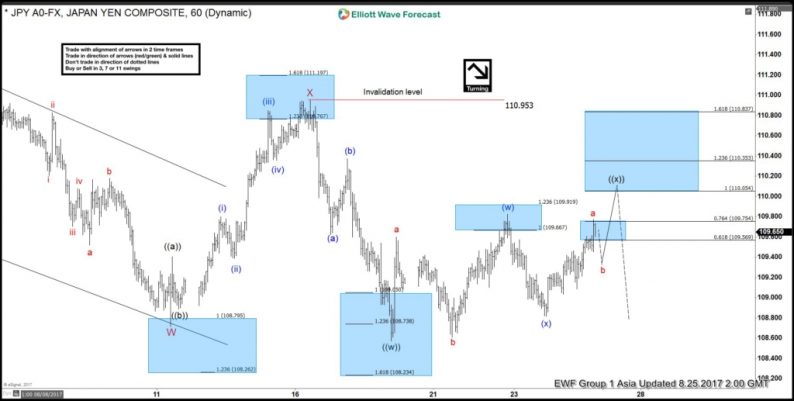

Short-term USDJPY Elliott wave view suggests that the decline from 7/11 peak is unfolding as a double three Elliott wave structure. The decline to 108.71 low ended Minor wave W and Minor wave X bounce ended at 110.95 peak. Subdivision of Minor wave Y is unfolding as another double three structure of a lesser degree. Minute wave ((w)) of ((Y) ended at 108.59 low and our revised view suggests Minute wave ((x)) of (Y) bounce remains in progress to correct cycle from 8/16 peak towards 110.05 – 110.35 before the pair turns lower. We don’t like buying the proposed bounce, and as far as pivot at 110.95 remains intact, expect sellers to appear at 110.05 – 110.35 for a new low or at least pullback in 3 waves.

USDJPY 1 Hour Elliott Wave Chart

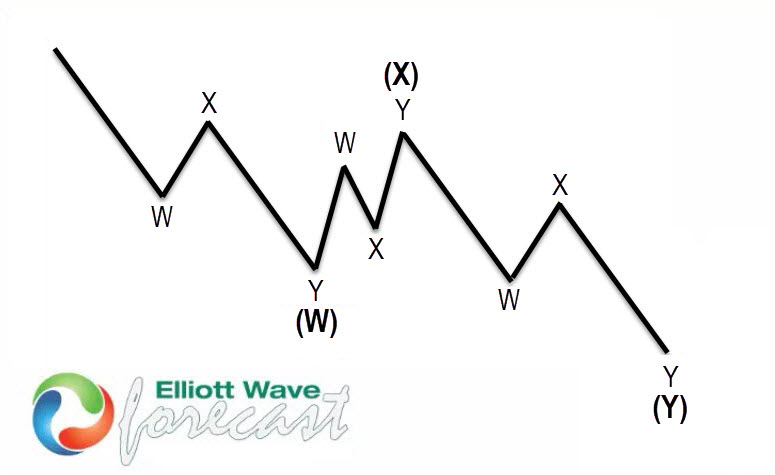

Double three ( 7 swings) is the most important pattern in Elliott wave’s new theory. It is also probably the most common pattern in the market these days. Double three is also known as a 7-swing structure. It is a very reliable pattern that gives traders a good opportunity to trade with a well-defined level of risk and target areas. The image below shows what Elliott Wave Double Three looks like. It has labels (W), (X), (Y) and an internal structure of 3-3-3. This means that all 3 legs have corrective sequences. Each (W) and (Y) is formed by 3 wave oscillations and has a structure of A, B, C or W, X, Y of smaller degrees.

Leave A Comment