The U.S. dollar extended its slide on Friday when Canada, the European Union and China blasted President Trump’s decision to impose tariffs on steel and aluminum imports. Canada called the tariffs unacceptable, but the EU and China threatened to take their own protective measures if the U.S. proceeds with their plans. The European Union has already called a meeting next week to discuss a response. The first step would be to appeal to the WTO – this happened under President George W Bush and it took a year and half before the tariffs were lifted. The WTO declared the steel tariffs under Bush as a violation of America’s WTO tariff-rate commitments and threatened $2B in penalty sanctions, Bush preserved the tariffs, the EU threatened to counter with tariffs on oranges and cars and he finally backed down. Foreign leaders may not be as patient with President Trump and could respond more quickly with specific tariff threats and actions. Either way, trade tensions will intensify before they improve which means further losses for USD/JPY.

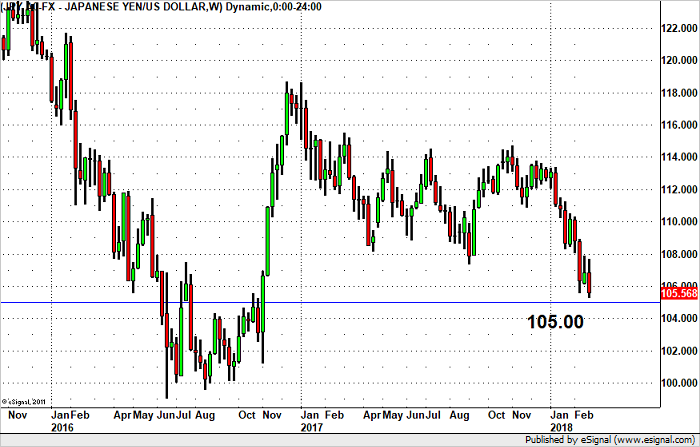

The threat of a trade war should overshadow U.S. data including the upcoming non-farm payrolls report because regardless of whether payrolls are strong or weak, there’s no question that Fed Chair Jerome Powell will raise interest rates later this month. With FOMC voter Dudley calling 4 rate hikes gradual, the dot plot forecast will also be revised upwards. Based on data, USD/JPY should appreciate into the jobs report but politics easily overshadows economics. If China starts talking about their own tariffs or expresses less desire to buy U.S. Treasuries (again), USD/JPY can break 105 quickly and easily.

Leave A Comment