Used Vehicle Prices Up

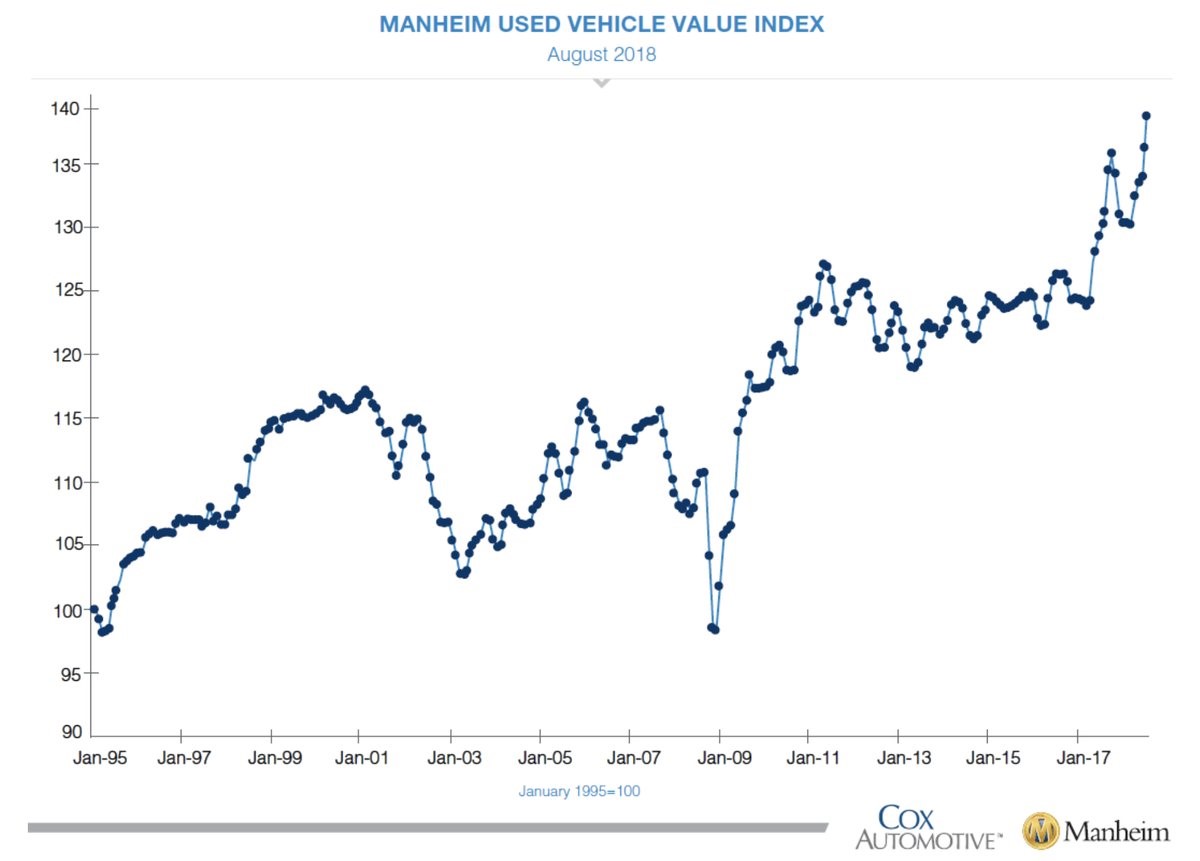

Used vehicle prices can be used to measure the strength of the economy. As you can see from the chart below, the Manheim used vehicle index cratered in late 2008 and was stable from late 2011 to early 2017.

The results in the past few quarters have been great. In August, the index was up 2% month over month and 6.4% year over year. So much for the fear of used car prices collapsing because of the huge inventory created by leases ending.

The supply is large, but the demand is larger. As of Labor Day, 3 year old vehicles are now worth 4.8% more than they would normally be worth. This is if they had normal depreciation occurred instead of the appreciation observed this year.

Prices went up because the economy is strong and the consumer is having a tough time affording new cars, so it is going the used route.

You can see that affordability has become a problem by looking at the year over year price changes in selective market classes shown in the chart below.

As you can see, only luxury cars saw a price decline.

Used Vehicle Prices – Results aren’t close to the heightened growth in the other categories.

This is bad for Tesla because it sells high priced vehicles. The Model 3 is supposed to be affordable, but the $35,000 base model isn’t available.

There were two other catalysts which caused prices to increase. First, buyers fear tariffs will cause prices to increase, so they want to get out ahead of the issue.

There are already tariffs on the metals used to produce cars. President Trump is threatening to put auto tariffs on cars from Canada and Europe. If the trade skirmishes end, used car prices will fall. If the tariffs are enacted, used car prices will skyrocket.

Used Vehicle Prices – It could actually become a great investment to buy a used car now and sell it after the tariffs are enacted.

The second catalyst is fear of rising interest rates. Buyers want to lock in the current rates when they take out loans, so they avoid paying higher rates next year.

Leave A Comment