I’ve written a lot about how the US dollar is the fulcrum of the global financial system.

Commodities are priced in dollars. Global trade is done in dollars. And the majority of international funding is in USD.

The dollar is important. Dollar trends impact markets and assets around the world in various ways. Hence why the dollar is the fulcrum.

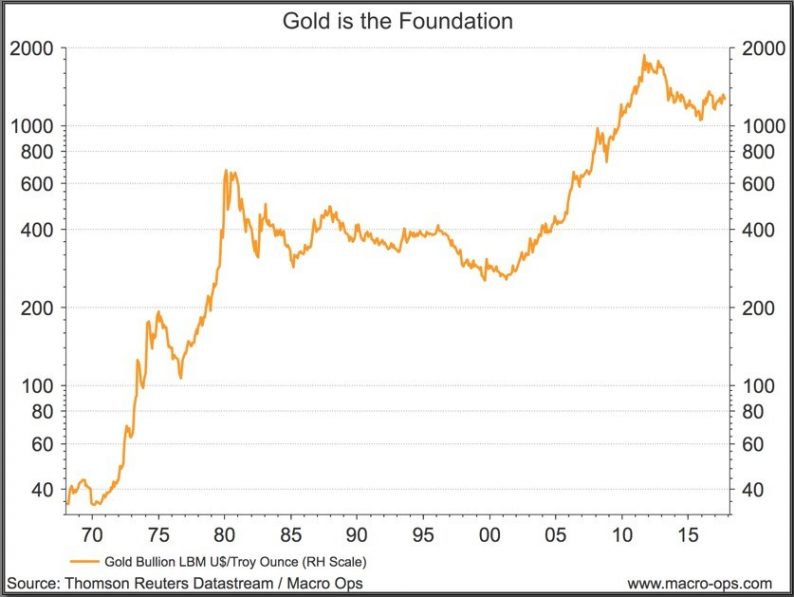

But if the dollar is the fulcrum then gold is the foundation on which that fulcrum sits.

I should make clear, I’m no gold bug and have no special affinity for the yellow metal.

But when it comes to analyzing assets and markets we run into a measurement problem. That measurement problem is due to the fact that things that are priced in US dollars, or any currency, fluctuate according to the price of the currency in addition to the good’s underlying supply and demand fundamentals (ie, the price of oil is impacted by the relative price of a US dollar).

And the price of dollars can fluctuate a lot.

You can see how this makes things difficult. When you analyze goods priced in USD you have to also assess the US dollar as well.

Gold is a useful tool helping with this measurement issue.

Perhaps due to gold’s long history as a store of value it has a special place in the market’s psyche. Since gold is priced in USD but has little intrinsic value (ie, little productive use and no cash flows) it acts as a good barometer to gauge the changing relative value of $1 USD of account or the price of 1 unit of USD liquidity (USD assets).

When international demand for USD liquidity exceeds supply, gold tends to perform poorly. And vice-versa when USD liquidity exceeds global demand for that USD liquidity.

Make sense?

Because of this, when I’m trying to discern the probabilities of where the dollar is headed next, I always start with gold. Even though gold is priced in dollars, it often leads to major turning points because the fundamentals are similar for both assets but for whatever reason, those fundamentals often show themselves in gold first.

Leave A Comment