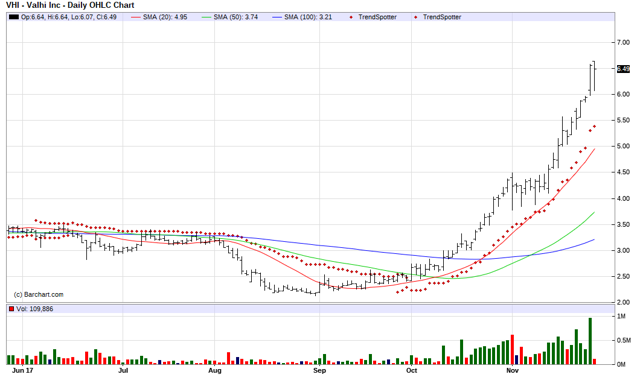

The Chart of the Day belongs to Valhi (VHI). Since the Trend Spotter signaled a buy in 10/2 the stock gained 140.45%.

Valhi Inc. operates through majority-owned subsidiaries or less than majority-owned affiliates in the chemicals, component products, waste management and titanium metals industries. These subsidiaries and affiliates are NL Industries, Inc., CompX International Inc., Waste Control Specialists LLC, and Titanium Metal Corporation.

Barchart technical indicators:

181.08+ Weighted Alpha

100% technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

12 new highs and up 63.75% in the last month

Relative Strength Index 76.86%

Technical support level at 6.17

Recently traded at 6.44 with a 50 day moving average of 3.74

Fundamental factors:

Market Cap $2.23 billion

P/E 10.80

Dividend yield 1.35%

Revenue expected to grow 9.20% next year

Earnings estimated to increase 273.70% this year and compound at an annual rate of 25.50% over the next 5 years

Although the one Wall Street analysts following the stock thinks it will under perform the market, the individual investors following the stock on Motley Fool voted 59 to 30 that the stock will out perform the market.

Leave A Comment