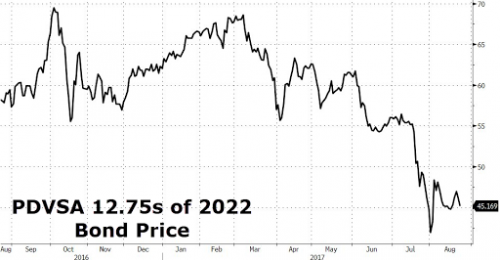

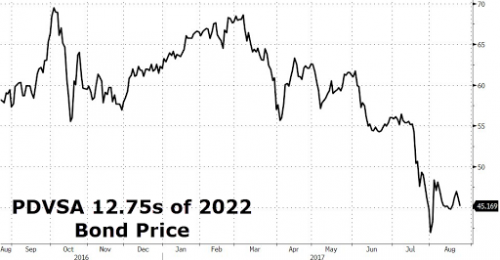

Venezuela bonds are tumbling after the WSJ reported that the US government was considering a ban on trading in the country’s debt. PDVSA’s 12.75% 2022s were trading at 44.75 this morning,down from around 45.65 at Tuesday’s close and two points weaker than levels seen earlier in the week, according to MarketAxess. Bond traders also sold PDVSA’s 6% 2026s, which had fallen about a point to 30.00.

On Tuesday evening, the WSJ reported that the U.S. government is considering “restricting trades in Venezuelan debt as it seeks to punish President Nicolás Maduro for undermining the country’s democracy” and that “the unprecedented move would temporarily ban U.S.-regulated financial institutions from buying and selling dollar-denominated bonds issued by the Republic of Venezuela and state oil company Petróleos de Venezuela SA, according to a person who was briefed on the proposal.”

One option being considered is banning the trading in just some papers issued by the state oil company to limit its access to external funds, said a third person. The ban would be the first step against the Venezuelan financial system since Mr. Trump promised “swift economic action” against Mr. Maduro for installing a parallel parliament staffed with loyalists earlier this month.

Then again, Trump may not have to lift a finger to accelerate Venezuela’s default. As reported last week, following the recent sanctions against Maduro’s socialist paradise, foreign banks are shutting out Venezuelan companies and are refusing to provide the country’s oil tankers with the letters of credit they need to offload oil, and replace it for one commodity most needed in Venezuela: hard dollars. As a result, the decline in PDVSA’s (and Venezuela’s) dollar reserves is accelerating with every day, a pace which roughly tracks the recent plunge in Venezuela bonds.

Or not.

Not everyone is convinced that Venezuela is facing an imminent default. In a separate report, the WSJ writes that one large holder of Venezuelan debt, Ashmore Group PLC, thinks investors have come to the wrong conclusion.

Leave A Comment