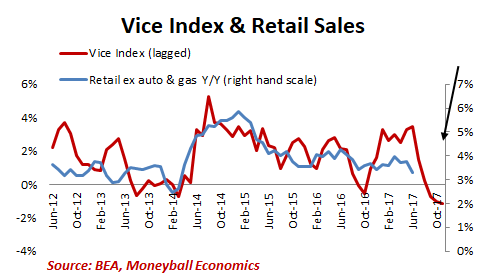

Vice Index Data: Downshifting

One of the important aspects of the U.S. economy is that recent business cycles have been longer. But also shallower.

I believe that the internet is playing a big role in this “lower-for-longer” phenomenon.

Increased communication that is the essence of the internet has also meant:

a) Pricing power reduction: Consider what is happening with retail store chain closings. They are casualties of the net: with a click of a button, mobile shoppers can find the lowest prices. And shippers can deliver the goods virtually overnight (if not sooner).

b) Supplier expansion: More suppliers means more competition

c) Consumer base expansion: Connecting suppliers and buyers has expanded the overall marketplace. With more buyers, producers can achieve profits through greater volume. It’s become a virtuous cycle – if you consider deflation virtuous

Simply put, it’s damn near impossible to create scarcity. And scarcity is at the heart of inflation and economic expansion.

But here’s the gotcha: this slow economy depends on low inflation.

Even a small uptick in inflation can cause severe economic shock. This is why the Fed interest rate hikes are so concerning.

When the economy is barely growing 2%, a 0.25% hike takes a big chunk out of the little growth that exists. Similarly, a small uptick in inflation has a larger impact than it might in the past.

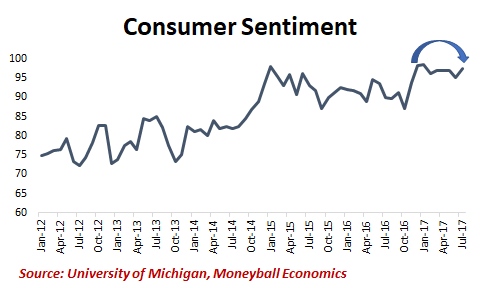

Consumers Begin To Reset Expectations

Companies did not get ahead of themselves, but consumers did…

Throughout the first half of the year (H1 2017), companies were positive but restrained: they did not buy into Trump promises of extra growth. This meant that they invested accordingly and did not over hire nor over invest.

However, households did buy into Trump’s promises.

Consumer Sentiment surged post-election: from the lowest levels in 2 years to the highest in 2 years.

Leave A Comment