Stock and Bond Bulls Telling Yellen To “Bring It”

In spite of the weak ISM Manufacturing November-2015 (actual @ 48.6 vs. consensus @ 50.5 and prior @ 50.1), the market responded with a robust rally. Regarding December’s impending rate hike, it’s almost as if stock market bulls are telling Fed Chairperson Yellen to “bring it”. However, CNBC’s David Faber made a most salient point earlier today in that the last time the Fed raised interest rates with the ISM below 50 was in August-1985. Anecdotal or fundamental? You be the judge.

Not all the economic data was bad. The PMI Manufacturing Index for November-2015 was solid @ 52.8 vs. consensus @ 52.6 and prior @ 54.1. Construction Spending in October-2015 increased 1.0% mth/mth vs. consensus @ 0.6% and prior @ 0.6%, while annual growth was @ 13.0% vs. prior @ 14.1%.

Tonight’s comments will be brief, but it would be remiss of me not to mention the sharp drop in Treasury rates which gave bonds a much needed boost. Perhaps the bond market is telling Yellen to “bring it” as well.

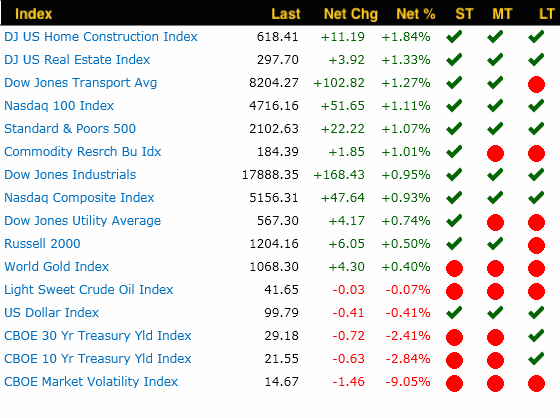

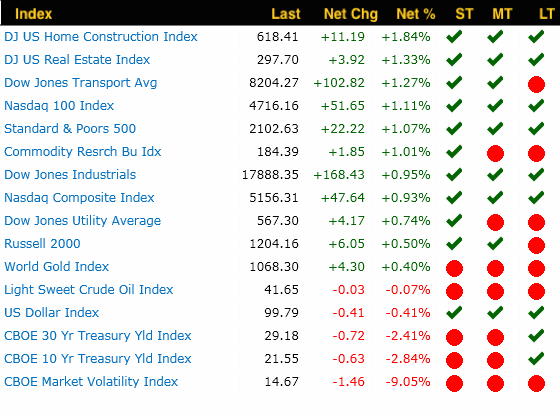

(Please see performance summary below for further reference on asset classes).

Performance Summary

Market Condition

Today the SP-500 broke out to a new 17-day high after seven days of consolidation, which establishes a higher base of price support for the benchmark index. It also closed above its 22-day moving average and it’s next challenge will be to break the resistance of the previous lower uptrend channel, which it failed in its last attempt during early November-2015. Momentum is just beginning to accelerate and the percentage of SP-500 components trading above their 200-day average has crossed into bullish momentum territory. Things should start to get interesting at this point. (If the market fails to break resistance a second time, there is a risk of a more severe correction than the previous one in November.)

Leave A Comment