The Framework of the Fed…

My more recent commentary mentioned how difficult it was to find a scapegoat for the market’s persistent decline. The drop in Crude Oil prices has been the financial media’s whipping boy lately, so when oil futures reversed their downward slide, the stock market responded in like manner, albeit synapse delayed .

Seriously? If this market is taking its cues from a recovery in oil prices, then we might encounter some disappointment down the road. The fundamentals have not drastically changed for energy and the demand is simply not there to meet the supply. So what’s going to happen if the rally in oil fades? Something to think about…

This week we have the Federal Reserve’s interest rate policy decision, which warrants more concern. A rate increase is a high probability, but what is not certain is the language that will be used to frame it. It’s not always about the picture or the painting folks. Never underestimate the influence of good framework, especially if it’s coming from the Fed.

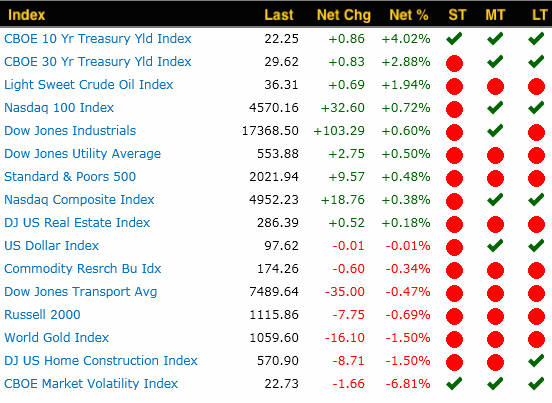

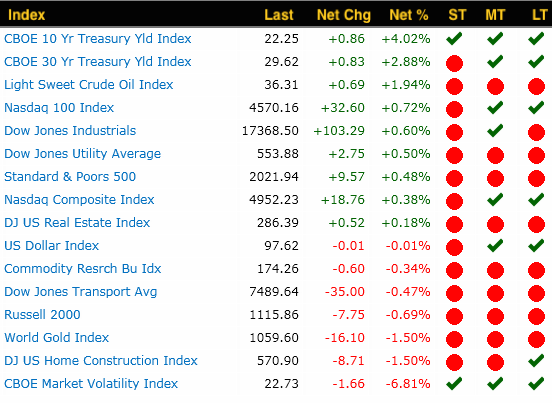

Performance Summary

*Trends: ST = short-term; MT = Intermediate-term; LT = long-term

Market Condition

The market obviously caught a bid today as it fell below 2000 and made another low, but managed to close in the upper part of its trading range. The trends and momentum both remain bearish. Resistance at the 55-day or widely followed 50-day moving average will dictate the market direction. Unless, we climb back over these levels, don’t expect more than a dead-cat bounce.

Hillbent on the Market Direction…

Daily Chart Technical Analysis

Market Breadth

Leave A Comment