Draghi’s Limp Stimulus Drags Down Markets

This evening’s comments will be brief, if any at all.

Today’s market was about as irrational as it gets. This time it was not Yellen who prompted the selling, but Europe’s chief central banker himself, Mario Draghi. Apparently he did not cut rates or increase QE stimulus enough and the market threw a tantrum. (Anticipate some readjustments as I am sure some will want to rethink this once they consider the comparative economic status between Europe and the USA.)

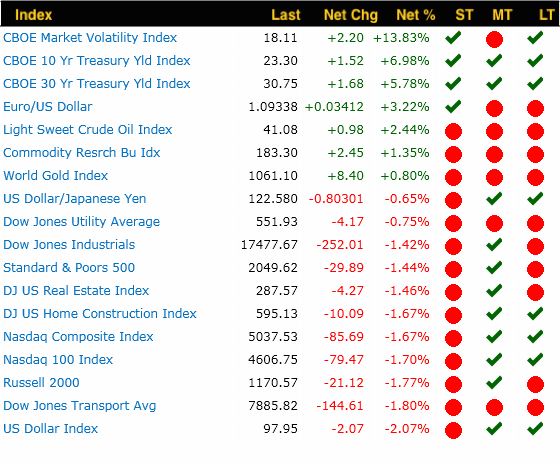

Performance Summary

*Trends: ST = short-term; MT = Intermediate-term; LT = long-term

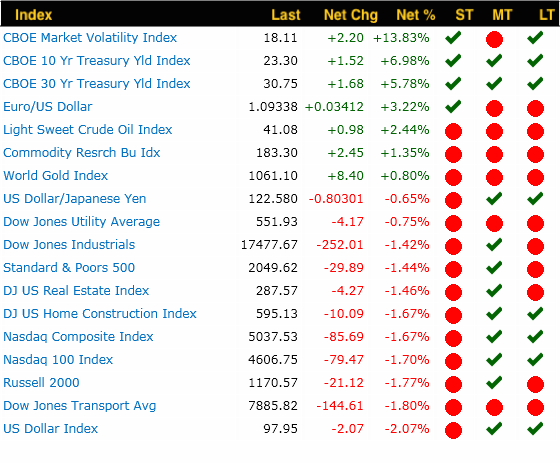

Market Condition

The bulls responded alright. They ran south like raped apes and hardly looked back. Violation of support at the current uptrend’s lower channel did not help morale much either. If they fail to reclaim this territory, then I do not think 2040 support will hold much longer and 2020-2015 is the next target. Unlike the SP-500, the Nasdaq-100 and Russell-2000 did just the opposite and maintained support at the lower channel of their respective uptrends. That in itself is a moral victory on a day like today. Let’s see what tomorrow brings.

Keep Hillbent for the Market Direction…

Daily Chart Technical Analysis

Volume Radar Alerts

Leave A Comment