All Quiet On The Equity Front

Retailers Home Depot (HD) and Walmart (WMT) reported solid earnings. However, this positive news for the retail sector was more or less offset by today’s inflation data which probably gives the Fed further justification for a rate hike. Outside of this, there were no other market moving data releases.

The Consumer Price Index for October-2015 was in line with expectations @ 0.2% mth/mth and improved annually @ 0.2% vs prior @ 0.0%.

Although Industrial Production for October-2015 was unchanged @ -0.2% mth/mth, the manufacturing component of the report improved significantly to 0.4% vs previous @ -0.1% while capacity utilization rates were flat @ 77.5%.

In real estate, today’s Home Price Index for November-2015 indicated some weakness in homebuilders as numbers came in @ 62 vs. consensus @ 64 and prior revised @ 65.

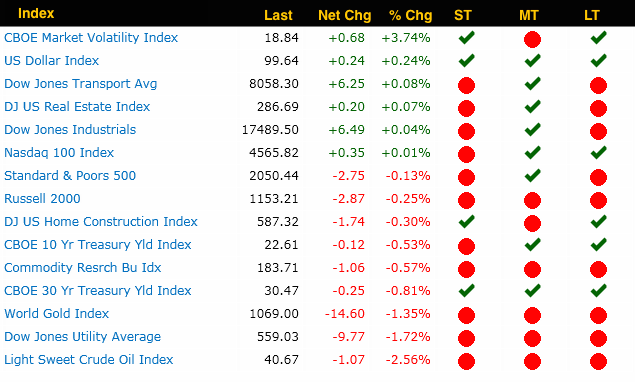

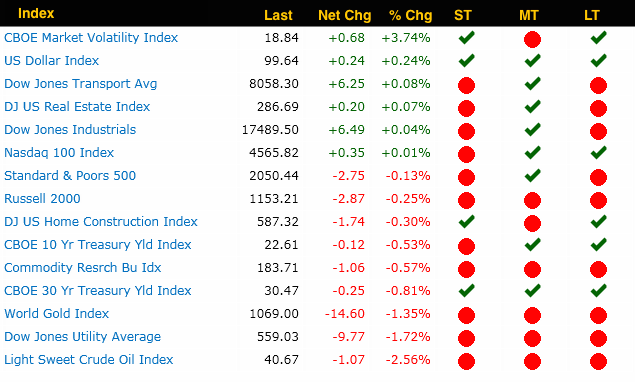

Overall, it was a relatively flat session for most asset classes, e.g. equities, U.S. Dollar, and real estate. Exceptions were volatility (VIX),today’s top performer, but with a relatively small gain and,at the losing end of the spectrum, gold, crude oil and utility stocks. Treasury rates receded slightly.

Performance Summary

Market Condition

This morning the SP-500 initiated a continuation rally from yesterday but, after two hours into the session, the momentum train derailed when it collided with its 22-day moving average. From there the market faded and finished in negative territory, albeit barely unchanged. Failure to surmount this resistance was a negative mark against the bulls. However, failure to squeeze more concessions from yesterday’s gains penalized the bears as well. Welcome to the first day of consolidation. Let’s see what tomorrow brings.

Until then, stay Hillbent for the Market Direction…

Leave A Comment