The Numbers

On Thursday April 20, 2017 Visa Inc. reported their fiscal second quarter earnings after the market closed at 4 p.m. Eastern Standard Time. The company reported $.86 per share which beat the $.76 estimate at Thomson Reuters. Revenue was 4.5 billion dollars versus an estimate of 4.3 billion. And to add the proverbial -icing on the cake- Visa also announced a 5 billion dollar share repurchase program for their class A common stock.

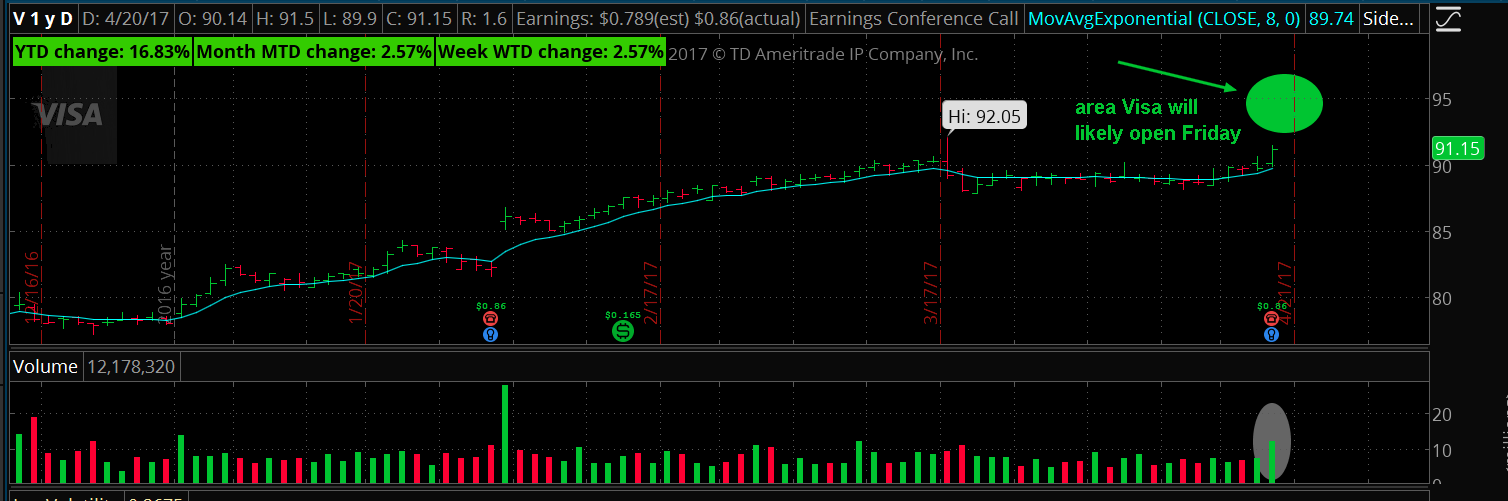

Shares of Visa have ranged in the past 52 weeks between $73.25 to a high of $92.05. The stock closed up 2.4% in the after-hours session at $93.35. This is likely where Visa will open for trading on Friday morning. In the regular session on Thursday however, shares also saw an increase of 1.6% and closed at $91.15.

Shares have been in a nice upward trend for the last 5 days leading up to today’s earnings release. Interesting of note were some unusual call option purchases in the last week or so as reported by the various institutions that do so-namely Chicago Board Of Options, Google Finance,Yahoo Finance, etc. Shrewd investors and traders could have seen this data and positioned themselves for a positive earnings announcement today.

The Charts

In the above price chart you will see the after-hours session from 4 p.m. until 8 p.m. for Visa. Please note the very long first green candle upward just as the earnings were announced. It ran from the closing price up to a high of $94.17.. After that it basically traded sideways closing at roughly $93.29.

The above price chart shows Visa price action on a daily basis. Note how it has been going sideways for the past two to three weeks. However with today’s volume, indicated at the lower right with a shaded oval area, shares were able to move up handsomely prior to earnings being released.

CEO COMMENTS

Alfred F. Kelly, Jr., CEO of Visa, commented:

“In the face of geo-political uncertainty, Visa continues to execute well against our operating plan and strategic priorities, delivering sustained growth across nearly every part of our business. Robust growth in payments volume, cross-border volume and processed transactions drove better than expected results. Looking ahead, we are continuing our efforts across the globe to electronify commerce and digitize economies to the benefit of consumers and societies alike.” -24/7 Wall St.

Leave A Comment