Virtually every corner of the closed-end fund (CEF) marketplace has been on an unrelenting grind higher over the last 18-months. Very few pullbacks have meant that you either had to be in these vehicles to capture the capital appreciation from the get-go or grind your teeth and jump in at some random point along the way.

More recently, we are starting to see signs of a shakeup across many sectors of the CEF universe. With stocks starting to take on a wobbly posture and high yield credit spreads compressed to multi-year lows, there is an atmosphere of uncertainty in the air. That can ultimately spell opportunity for those who have been waiting patiently on the sidelines for new dislocations to present themselves.

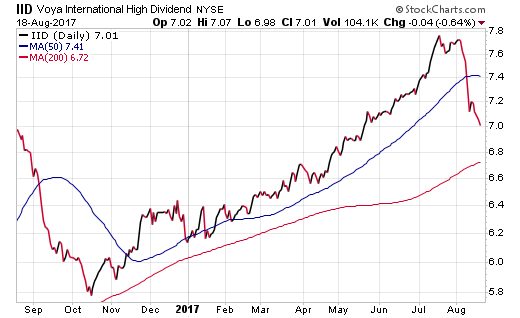

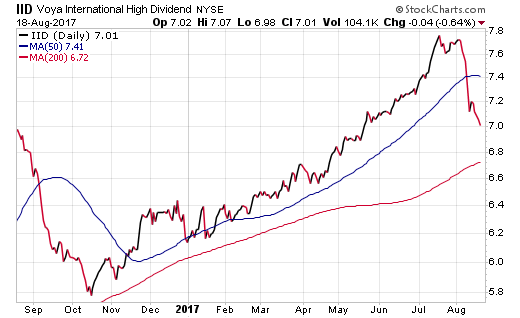

Take for example the Voya International High Dividend Fund (IID), which a hawk-eyed client pointed out last week. This small $60 million fund is primarily made up of global large-cap dividend stocks and recently peaked at an exorbitant +12% premium to its underlying net asset value (NAV).

The recent dip shown on the chart above has quickly reset the price to a more palatable -0.85% discount to NAV as of Friday’s close. This type of sharp drop is common throughout the CEF landscape when certain funds get too far over their ski’s. It’s also typical to see an immediate re-pricing in closed-end funds due to a drastic portfolio change, dividend reduction, or management shakeup.

Such are the risks of owning an asset whose price is driven heavily through sentiment as opposed to the actual underlying performance of its stock or bond portfolio. This point is crucial for CEF investors to understand as price trends often overextend (in both directions) for far longer than most think is possible. It’s a much different risk dynamic than buying an open-ended mutual fund or ETF that trades at or very near its daily NAV.

Another closed-end fund asset class that has been under fire in recent weeks are master limited partnerships. A chart of the Kayne Anderson Energy Total Return Fund (KYE) tells the story for much of this group. The compression of energy stocks and volatility in commodity prices has created an unpredictable trading environment for these funds.

Leave A Comment