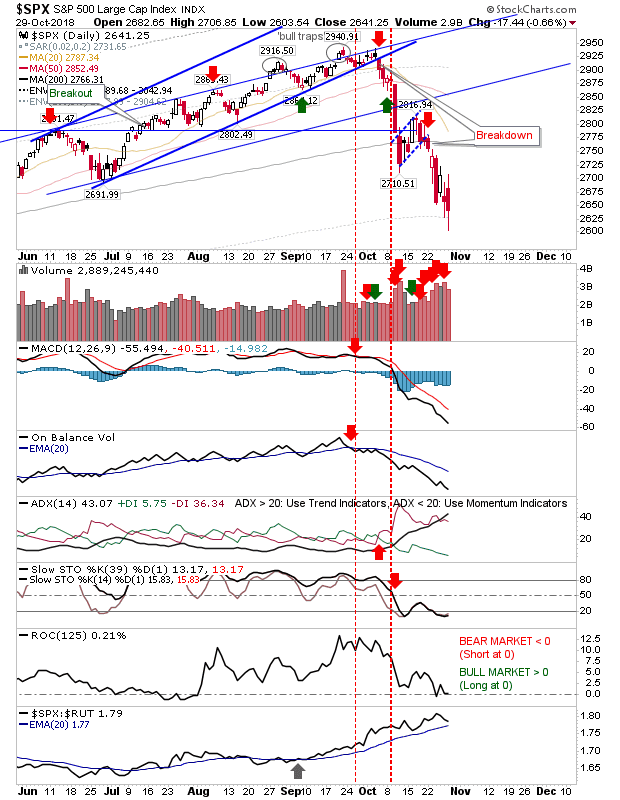

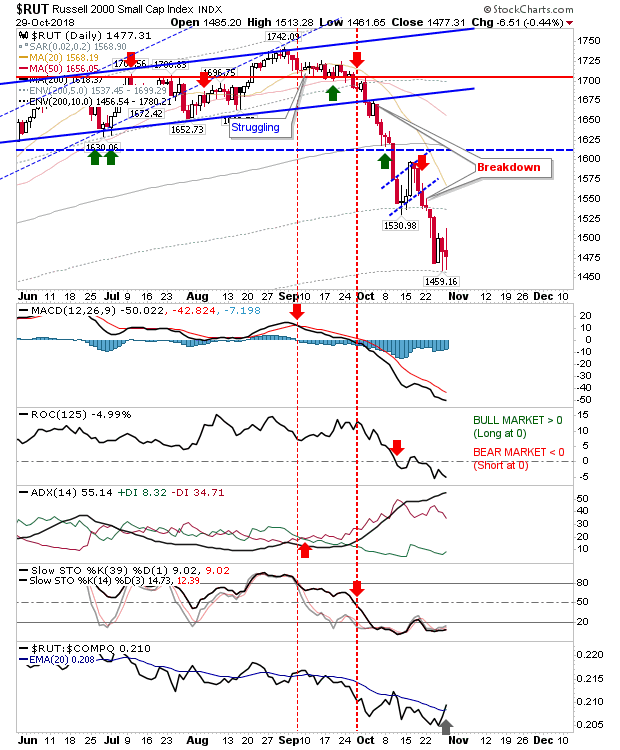

Intraday ranges were wide as indices struggled between building swing lows or selling off even more. By the close of today’s business, indices were indicating lows are not in place and further declines are likely but these may be nothing more than spike lows (on yet another wide range day). Whatever happens, the investor `buy`signals are still in effect for the S&P and Russell 2000.

The S&P experienced a 4% range between highs and lows as the relative performance continued to swing back to Small Cap stocks (after an extended period of outperformance from September). Sellers look to be exhausting themselves as volume took a significant drop.

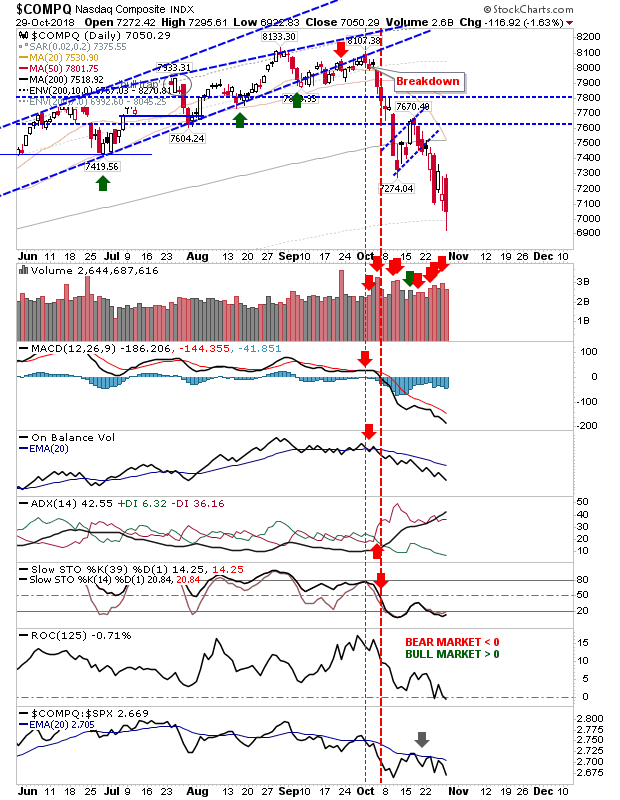

The Nasdaq suffered a loss of 1.5% as relative performance took another tick lower. Volume was lighter, which is perhaps bullish given the acceleration low, but this is one index which hasn’t yet reached the investor ‘buy’ zone.

The Russell 2000 moved from a bullish ‘hammer’ to an indecisive ‘spinning top’, but the key was that Friday’s lows were not violated. I’m still liking this index for long-term buyers. Better still there was a sharp uptick in relative performance. Don’t be afraid to step in!

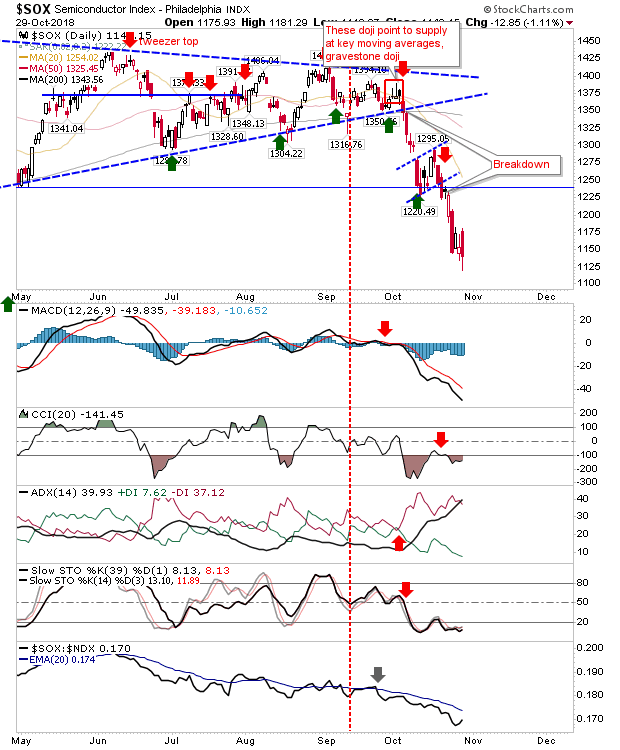

The Semiconductor Index keeps on falling as it seeks a bottom.

For tomorrow, watch for reversal candlesticks. Today negated the immediate bottom watch but markets are close (Nasdaq) or in (Russell 2000 and S&P) to a significant trading low

Leave A Comment