There is an eerie calm in the markets ahead of the highlight for the day and week. The central banks of the eurozone, UK, and Turkey hold policy meetings, and the US reports August CPI.

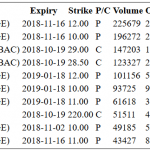

The greenback is a mostly firmer, with the Australian dollar as the notable exception. On the one hand, we would note that is it higher for the fourth consecutive sessions, after finding some support near $0.7100 earlier in the week. A stronger than expected jobs report help lift the Aussie to $0.7200 today, and there is an A$ 753 mln option expiring at $0.7220 today.

Australia report growing 44k jobs in August, nearly three times more than expected and mostly accounted for by a nearly 34k increase in full-time positions. The participation rate ticked up to 65.7% from a revised 65.6%, but the unemployment rate was steady at 5.3%. While the data is constructive, there is not much impact on the outlook for monetary policy. Offsetting the jobs growth is soft wage pressures, subdued inflation, and weaker house prices.

Another notable feature of the Asian session was the rally in equities. All markets in the region participated, except Australia, where the ASX 200 fell 0.75%. The MSCI Asia Pacific Index gained almost 1.0% to snap ten-day slide. It gapped higher and follow-through buying tomorrow will be key to the near-term outlook. The MSCI Emerging Markets Index is also up around 1% before the Latam session, and it is the second day of gains.

There are two areas in which the market may be getting ahead of itself. The first is on the trade. Reports yesterday that the US Treasury has invited Chinese officials for talks in Washington helped spur a risk-on rally. We are skeptical. In May, the US Treasury appeared to have struck a deal with China that would lead to it buying much more US products. However, President Trump backed off and by doing so, sent a signal to China that the trade issue will not be resolved by the Treasury Department. The reports of an intended meeting follow press reports covering the warnings by several larger banks that across the board tariffs on China that the US was threatening would likely trigger a sharp drop in US stocks, perhaps wiping out next year’s anticipated earnings growth.

Leave A Comment