With the stock market hitting record highs day after day, many value focused investors are understandably nervous about investing new money at this time.

Fortunately, there are still a few industries where high-yield dividend investors can turn to for generous, secure, and growing dividends.

One of these is Real Estate Investment Trusts, or REITs; the easiest way for dividend investors to gain exposure to real estate. Many REITs have sold off in recent months as rising interest rates have made them relatively less attractive investments.

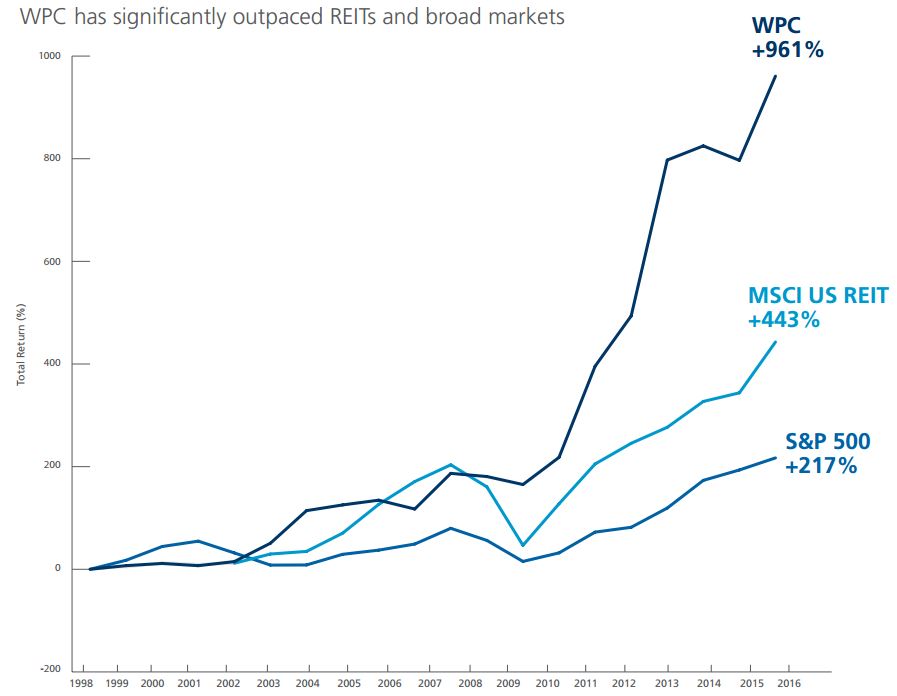

W.P. Carey (WPC) converted to REIT status in 2012 and has seen its stock price decline 18% since early August. However, the company proven itself a master at growing long-term investor income and wealth over time.

In addition to its high 6.6% yield, the company is a dividend achiever that has paid uninterrupted dividends since 1998 and increased its dividend annually for 18 consecutive years.

With the recent pullback in its share price, let’s take a closer look at W.P. Carey for consideration in our Conservative Retirees portfolio.

Business Description

Founded in 1973, W.P. Carey is one of the oldest REITs in the world and a pioneer in the sale/leaseback model of triple net REITs.

Essentially W.P. Carey raises capital from investors and then purchases freestanding real estate from companies, who then sign long-term (i.e. 20 to 25 years) rental agreements to pay rent to W.P Carey for the use of those properties.

Companies are willing to do this because they are able to monetize the value of their real estate in a tax-efficient manner by getting upfront capital, and they can deduct 100% of rent from their income statements, boosting earnings.

Another appeal of the business model is that these are triple net leases, meaning the tenant is responsible for maintenance, taxes, and insurance. In other words W.P. Carey only has to buy the properties and then sit back and collect rent.

This creates a low overhead business model in which the REIT generates high adjusted funds from operations, or AFFO (REIT equivalent of free cash flow and what funds the dividend), which must be paid out to investors for tax reasons in the form of generous, secure, and growing dividends.

But what specifically makes W.P. Carey a standout in the world of sale/leaseback triple net leases?

For one thing, most triple net REITs, such as blue-chip giants Realty Income (O) or National Retail Properties (NNN), are primarily focused just in the U.S. and specialize in retail properties.

However, as you can see below, W.P. Carey offers investors far more global diversification, with just over one third of its properties located overseas.

More importantly, its 910 properties are spread out over far more REIT sectors, including hot growth markets such as warehouses, which are experiencing strong growth due to the rise of e-commerce and the growing need for more fulfillment centers.

Source: W.P Carey Annual Report

This greater regional and industry diversification means that W.P Carey enjoys very stable and predictable cash flow, which makes it a sleep well at night, or SWAN stock.

Finally, the third major difference between W.P Carey and its peers is that in addition to owning a global portfolio of rental properties, it operates a highly successful investment management division.

In fact, since inception, the REIT’s investment management division has generated 11%, net of fees, compound annual returns for its investors.

Such strong performance explains why W.P Carey has $12.2 billion in assets under management, up 16% compared to Q3 of 2015.

The company’s non-traded REIT management division not just provides the REIT with future potential growth opportunities, but also fast-growing and lucrative management fee revenues (up 35% year-over-year) that made up 20% of the REIT’s total revenue in the most recent quarter and 8% of AFFO over the last year.

Business Analysis

The key to any long-term investment is quality management. W.P Carey has built its business around a long-term focus of acquiring quality properties around the globe at opportunistic prices and slowly but surely growing its cash flows in a disciplined manner.

It’s important to remember that because W.P Carey operates as a hybrid of a traditional equity REIT as well as a private equity fund, its growth in revenue, cash flow, and dividends can be lumpy.

Leave A Comment