W.W. Grainger (GWW) has been among the biggest losers in the S&P 500 so far this earnings season. Shares have lost 20% of their value in just the past three months.

The stock fell 11% on Tuesday, April 18th, after the company announced disappointing first-quarter earnings.

Not only did Grainger miss analyst expectations on both sales and earnings for the quarter, but it also lowered its forecast for the full year.

But, long-term investors should not be swayed by one quarter’s results.

Grainger has a long track record of rewarding shareholders. It has raised its dividend for 45 consecutive years. Grainger is a Dividend Aristocrat, a group of companies in the S&P 500 that have raised dividends for 25+ years.

With five more years of increases, Grainger will become a Dividend King, a group of just 19 companies that have raised dividends for 50+ consecutive years.

This article will discuss why Grainger’s 20% decline make it more attractive for long-term investors, not less.

Business Overview

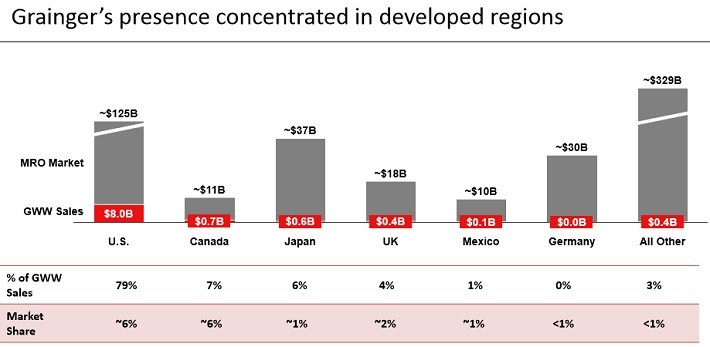

Grainger supplies maintenance, operating, and repair products—MRO, for short— around the world. These are things like safety products, power tools, test instruments, and motors.

Grainger has a presence in many international markets, such as Japan, the U.K., Mexico, and Germany.

However, most of its business is derived from North America, where it operates 700+ branches and 30+ distribution centers.

Source: 2016 Analyst Meeting Presentation, page 6

Grainger’s core business is with large U.S. customers. These customers represent approximately 60% of the company’s total revenue.

Revenue from this customer segment declined 1% last year. This caused Grainger’s adjusted earnings-per-share to decline 3% in 2016.

Conditions have not improved so far in 2017.

In the first quarter, Grainger’s revenue rose 1%, but adjusted earnings-per-share declined 9%, year over year.

Leave A Comment