Are you a frequent visitor to retail drugstores? Then you must have come across at least one of the more than 13,200 drugstores operated by Walgreens Boots Alliance, Inc. (WBA – Free Report). This Illinois-based company is the first global pharmacy-led, health and wellbeing enterprise.

Currently, Walgreens Boots has a Zacks Rank #3 (Hold) but that could change following its impressive first quarter fiscal 2018 earnings report which has just released.

We have highlighted some of the key details from the just-released announcement below:

Earnings: Walgreens Boots’ adjusted earnings per share of $1.28, up 16.4% year over year surpassed the Zacks Consensus Estimate figure of $1.27.

Revenues: Walgreens posted revenues of $30.74 billion grew 7.9% year over year which is ahead of the Zacks Consensus Estimate of $30.33 billion

Key Stats: In the reported first quarter fiscal 2018, revenues from the Retail Pharmacy USA division increased 8.9% to $22.5 billion, while revenues from the Pharmaceutical Wholesale division rose 5.6% to $5.7 billion. Revenues from the Retail Pharmacy International division also rose 4.1% to $3.1 billion. Moreover, Walgreens Boots filled 260.2 million prescriptions (including immunizations) on a 30-day adjusted basis in the quarter, reflecting an increase of 9.5% over first quarter of fiscal 2017.

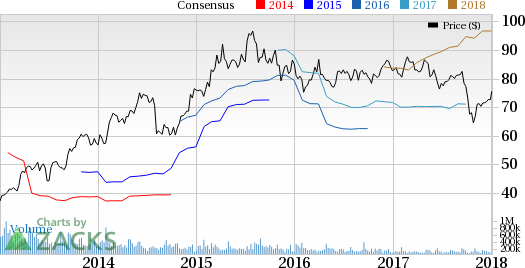

Walgreens Boots Alliance, Inc. Price and EPS Surprise

Walgreens Boots Alliance, Inc. Price and EPS Surprise | Walgreens Boots Alliance, Inc. Quote

Major Factors: Per management, Walgreens Boots first quarter 2018 results were encouraging. This is on account of the company’s strategic tie-ups which brought more patients to its U.S. pharmacies. The company has also been gaining increased market share in the Retail Pharmacy USA segment along with growing prescription volumes. Management is currently optimistic about its ongoing cost transformation program and remains confident about the long-term growth of the company. The company has increased the lower end of its outlook for fiscal year 2018 by 5 cents per share and anticipates adjusted earnings per share of $5.45 to $5.70.

Leave A Comment