Walgreens Boots Alliance, Inc. WBA reported adjusted earnings per share (EPS) of $1.48 for fourth-quarter fiscal 2018, up 12.9% year over year (same at constant exchange rate). The figure surpassed the Zacks Consensus Estimate of $1.44.

On a reported basis, net earnings came in at $1.5 billion, reflecting an 88.5% surge from the prior-year quarter. Reported EPS came in at $1.55, up 103% on a year-over-year basis.

Full-year adjusted EPS was $6.02, reflecting an 18% rise from the year-ago period. The figure also surpassed the Zacks Consensus Estimate of $5.98 per share.

Total Sales

Walgreens Boots recorded total sales of $33.44 billion in the fiscal fourth quarter, up 10.9% year over year and 11.3% at constant exchange rate or CER. However, the top line missed the Zacks Consensus Estimate of $33.64 billion.

For the full year, the company reported revenues of $131.53 billion, an 11.3% improvement from the year-ago period. However, the reported figure lagged the Zacks Consensus Estimate of $131.60 billion.

Segments in Detail

Walgreens Boots reports under three operating segments: Retail Pharmacy USA, Retail Pharmacy International and Pharmaceutical Wholesale.

Retail Pharmacy USA- The segment recorded sales of $25.5 billion in the fourth quarter, highlighting an improvement of 14.4% year over year. Within this segment, total sales at comparable stores edged up 0.3%, while prescriptions filled in comparable stores increased 1.3% year over year. With the addition of Rite Aid stores, retail sales increased 8.3% year over year. However, comparable retail sales dropped 1.9%.

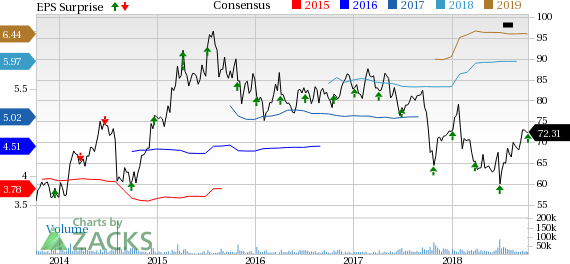

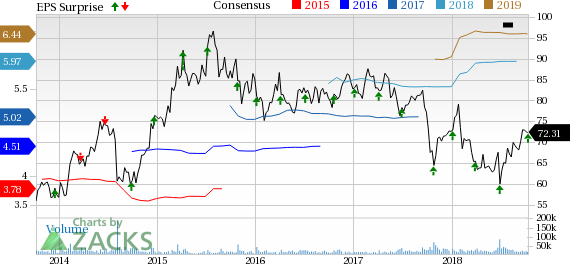

Walgreens Boots Alliance, Inc. Price, Consensus and EPS Surprise

Walgreens Boots Alliance, Inc. Price, Consensus and EPS Surprise | Walgreens Boots Alliance, Inc. Quote

Pharmacy sales, which accounted for 73.6% of the Retail Pharmacy USA division’s sales in the quarter, increased 16.7% from the year-ago quarter on higher prescription volume from the acquisition of Rite Aid stores and central specialty. Pharmacy sales at comparable stores improved 1.3% year over year on higher volume.

Leave A Comment