– U.S. Durable Goods Orders to Contract for Sixth Time in Last 11-Months.

– Non-Defense Capital Goods Orders ex Aircrafts to Decline for First Time Since August.

Trading the News: U.S. Durable Goods Orders

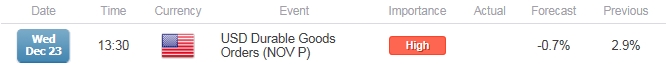

A 0.7% decline in orders for U.S. Durable Goods accompanied by a weakening outlook for business investments may produce near-term headwinds for the greenback and spark a larger rebound in EUR/USD as it drags on interest rate expectations.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Even though the Federal Open Market Committee (FOMC) appears to be on course to further normalize monetary policy in the year ahead, signs of persistent slack in the real economy may keep the ‘data dependent’ central bank on the sidelines throughout the first-half of 2016 in an effort to mitigate the downside risks surrounding the region.

Expectations: Bearish Argument/Scenario

Release

Expected

Actual

U. of Michigan Confidence (DEC P)

92.0

91.8

Consumer Credit (OCT)

$20.000B

$15.982B

Average Hourly Earnings (YoY) (NOV)

2.3%

2.3%

Subdued wage growth along with the slowdown in private-sector credit may drag on demand for large-ticket items, and a sharp decline in Durable Goods Orders may prompt the central bank endorse a wait-and-see approach at the January 27 interest rate decision as it dampens the outlook for growth and inflation.

Risk: Bullish Argument/Scenario

Release

Expected

Actual

Gross Domestic Product (Annualized) (QoQ) (3Q F)

1.9%

2.0%

Non-Farm Payrolls (NOV)

200K

211K

ADP Employment Change (NOV)

190K

217K

Leave A Comment