When the Fed rate hike that nearly everyone expects finally happens, a lot of U.S. companies that have been surviving on cheap debt will get pushed into oblivion.

Remember, the U.S. Federal Reserve hasn’t raised interest rates since 2006. And it has kept rates near zero since the end of 2008. In that time, corporate America has grown addicted to cheap debt.

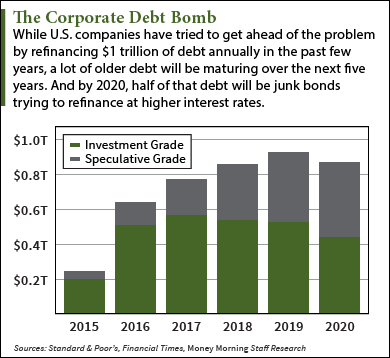

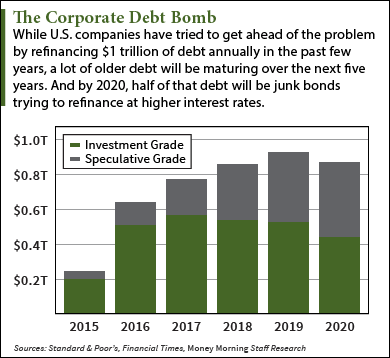

Corporate treasurers refinanced $1 trillion worth of debt each year between 2012 and 2014. Some of that debt has gone to finance acquisitions. Some has gone to finance returns to shareholders in the form of stock buybacks and increased dividends.

But weaker companies – those whose high-yield debt is known as “junk” – have been borrowing just to keep the doors open. And borrowing by these companies was up 21% in the first six months of the year from the same period in 2014.

A Fed interest rate hike will force such “zombie” companies to pay investors more to buy their debt. And many won’t be able to afford it.

Why Junk-Rated Companies Dread a Fed Interest Rate Hike

“Because BB-, B-, and in some cases CCC-rated companies have been able to borrow at less than 5%, a host of zombie and future zombie corporations now roam the real economy,” bond guru Bill Gross wrote in his August letter.

Such companies face an existential threat from a Fed rate hike. And if the Fed doesn’t raise interest rates in December, it will almost certainly raise them in early 2016.

We’re already seeing signs of trouble. So far this year, 47 companies have defaulted, the most since 2009.

And Standard & Poor’s U.S. distress ratio, the portion of distressed securities among junk bond-rated companies, hit 15.7% in September. That’s the highest level since December 2011.

One zombie company, Unisys Corp. (NYSE: UIS), ran into problems in September when it had to withdraw its offer to sell $35 million of bonds. The junk bond offering, with an expected yield of about 8%, failed to price. Investors wouldn’t bite.

Leave A Comment