Dow Jones Transportation Average (DJT):

SHORT-TERM/DAILY:

Last Thursday, November 30, the DJT broke out to a new record high of 10,347.93. The following day the market quickly fell to support of 10,011.95, closing down for the day at 10,186.63. This activity formed a 2-day short-term reversal candle pattern known as a ‘bearish harami’, and it is especially powerful after an extended or strong bull run such as seen over the preceding two weeks.

(A ‘harami’ candlestick pattern is present when the current period’s open and close occurs inside the open and close of the preceding period. With a ‘bearish harami’ the pattern shows up after the market advances, with an up-close period followed by a down-close period, with the inside open and close.)

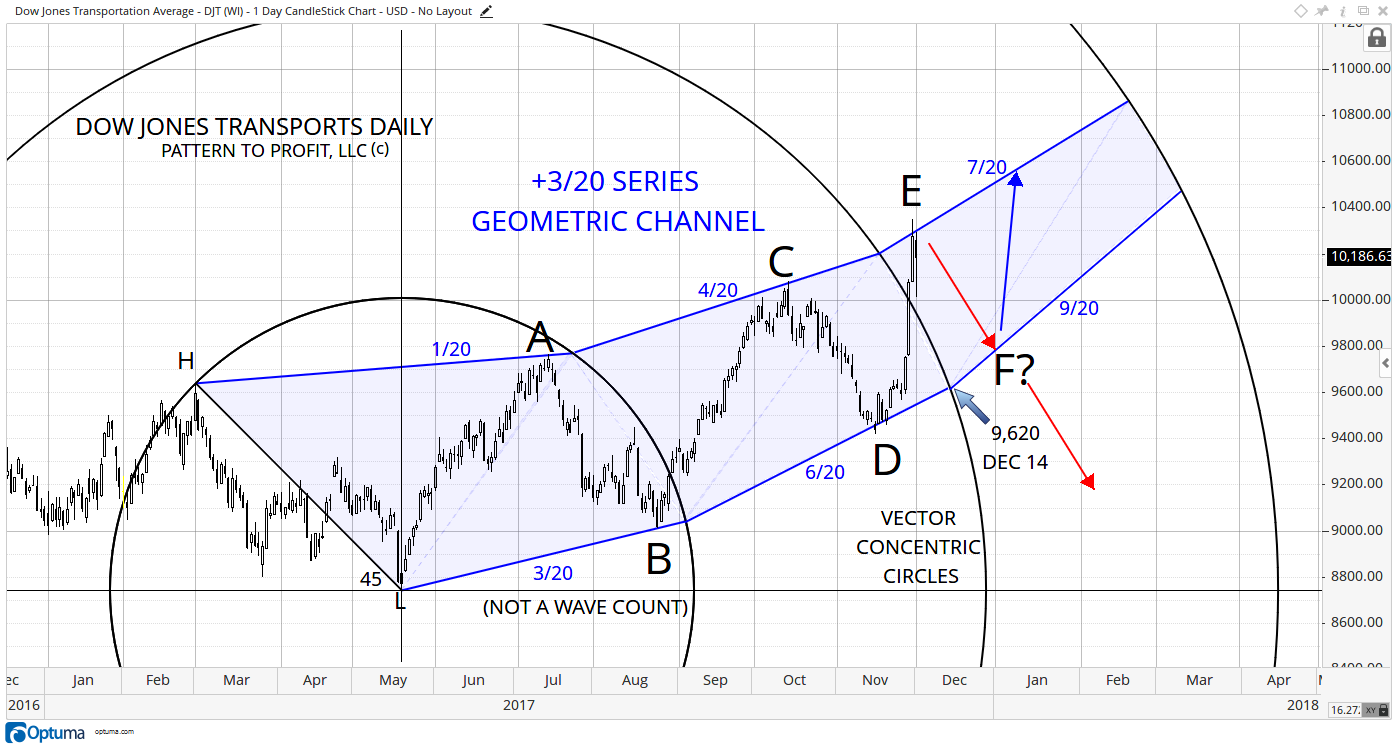

However, one candle reversal pattern does not a trade make. The following chart presents this bearish harami at the top of a geometric channel that identifies the rather stodgy uptrend quite effectively (points A-E):

By aligning the chart’s vertical scale such that the initial downtrend (black, marked H-L) is seen at the crucial 45o (the perfect division of price and time), the subsequent price action can be revealed as perfectly conforming to the shown geometric channel of angles based on 5ths and increasing by +3/20.

Based on this observation, the following points can be derived:

Leave A Comment