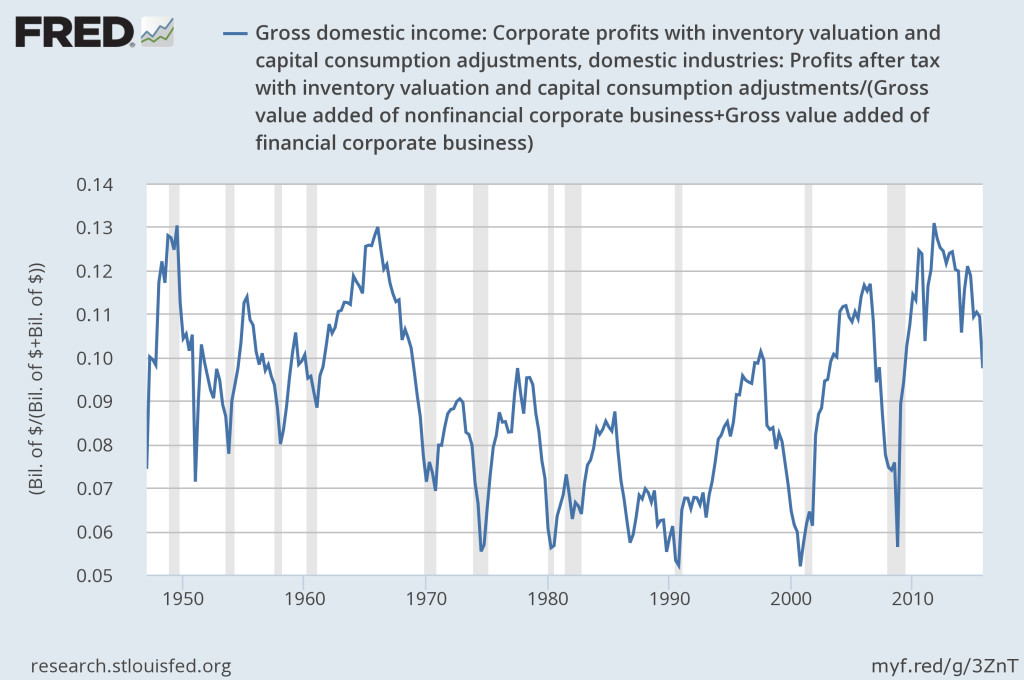

Over the past few years I’ve written a fair amount about the record-high levels of corporate profit margins. I’ve been focused on this topic because corporate earnings are one of the most popular ways to value equities thus the sustainability of record-high profit margins should be an issue of great concern to investors. If profit margins revert to historical averages, earnings-based valuation measures investors are using to justify investment in equities today could quickly go against them making stocks appear much more expensive than they do currently. And this process may now be underway.

To the point of mean reversion in profit margins, in the past I have referenced the words of a pair of investment legends. Jeremy Grantham has called profit margins, “the most mean-reverting series in finance.” And back in 1999, Warren Buffett explained why:

In my opinion, you have to be wildly optimistic to believe that corporate profits as a percent of GDP can, for any sustained period, hold much above 6%. One thing keeping the percentage down will be competition, which is alive and well. In addition, there’s a public-policy point: If corporate investors, in aggregate, are going to eat an ever-growing portion of the American economic pie, some other group will have to settle for a smaller portion. That would justifiably raise political problems—and in my view a major reslicing of the pie just isn’t going to happen.

Both of these two gentlemen clearly believe, and very strongly, that corporate profit margins have an equilibrium. They can rise above or fall below that equilibrium but the very nature of capitalism, along with its social contract, will force an inevitable reversion to the mean.

I believe there are three major factors behind the recent bubble in corporate profit margins. First, and most obvious, is the simple trend in interest rates over the past 35 years or so. As rates have fallen to lows not seen in many generations, debt has become much less costly, especially when you also consider that corporate spreads on top of these ultra-low rates have also fallen to ultra-low levels.

Leave A Comment