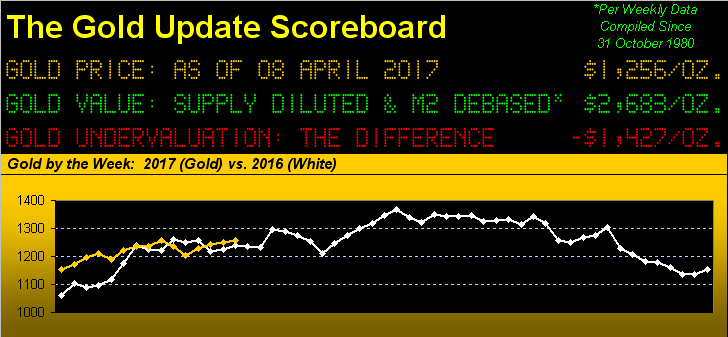

Gold failed to follow-through from two fundamental forces which for Friday’s session flew past in a 12-hour blast. In turn, cue Gold’s technical view and the year-to-date up run may be through, at least for a week or few. To be sure, a glance at the above panel shows Gold gliding along just off the tarmac of where ’twas at this time a year ago. But in settling out the week yesterday at 1256 came the following screen from our end-of-day mix:

The two fundamental catalysts upon which Gold could not follow-through in yesterday’s (Friday’s) session were:

? the US’ response to Syria’s humanitarian atrocities, Gold leaping from 1252 to 1271 in 60 minutes, before backing off to 1263; and then 12 hours later,

? the US’ Department of Labor report for interest rate-relieving marginal growth in payrolls and hourly earnings, Gold in turn re-leaping to 1273, only to then give it all back in settling the week at 1256.

Reminiscent of the ’73 Elton John piece  “I’ve Seen That Movie Too”

“I’ve Seen That Movie Too” , we oft dubiously view Gold’s capitalizing on geo-political events, typically with the Syrian affair of the impulsive safe haven rush in spiking price up, only to be followed by a sauntering back down from whence it came. But then, the failure for Gold to hold its gains post-payrolls — the weakening data from which almost shall surely keep the Federal Open Market Committee at bay come 03 May — and ’twas “TILT! … Game Over”, perhaps for a bit anyway. Here’s why we so say:

, we oft dubiously view Gold’s capitalizing on geo-political events, typically with the Syrian affair of the impulsive safe haven rush in spiking price up, only to be followed by a sauntering back down from whence it came. But then, the failure for Gold to hold its gains post-payrolls — the weakening data from which almost shall surely keep the Federal Open Market Committee at bay come 03 May — and ’twas “TILT! … Game Over”, perhaps for a bit anyway. Here’s why we so say:

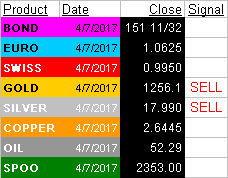

Open the technical tool-kit and this is what we find. See the word “SELL” next to both Gold and Silver in the prior graphic? This is what generates those signals: yes, as below denoted by the two red arrows, our old prescient friends the “Baby Blues” have just kinked down within their scales’ +80% levels. That means the consistencies of the recent uptrends for both Gold on the left and Silver on the right have started to erode. And as you look across the two panels, indeed if you regularly following the “blues” day-by-day at the website, you know they’re fairly reliable in heralding changes in trend:

Leave A Comment