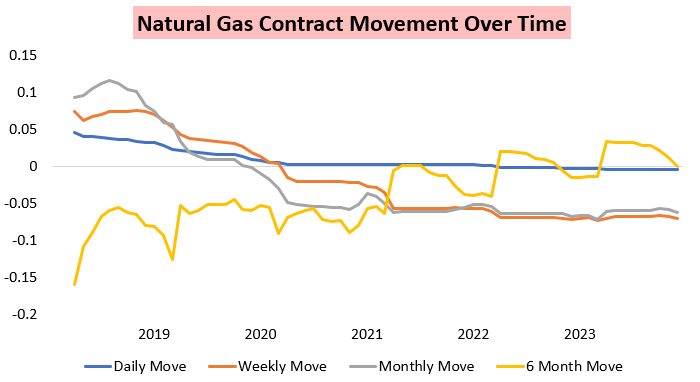

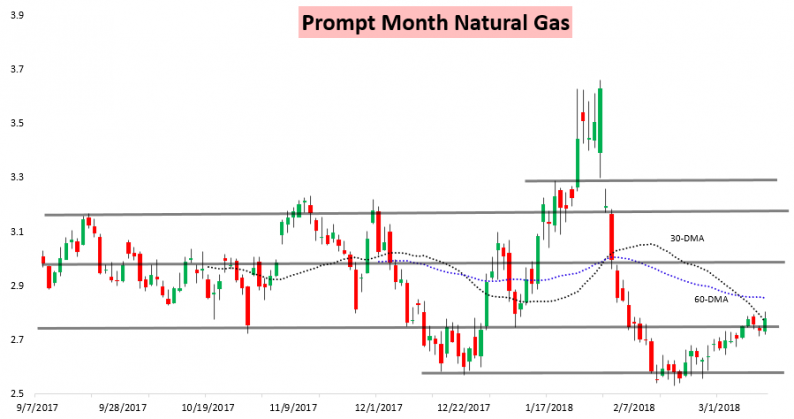

April natural gas prices were finally able to get moving today, registering their largest percentage daily move since February 20th as prices moved 1.7% higher on colder weekend forecast revisions.

This was a textbook weather-driven move, with the front of the natural gas strip leading prices higher.

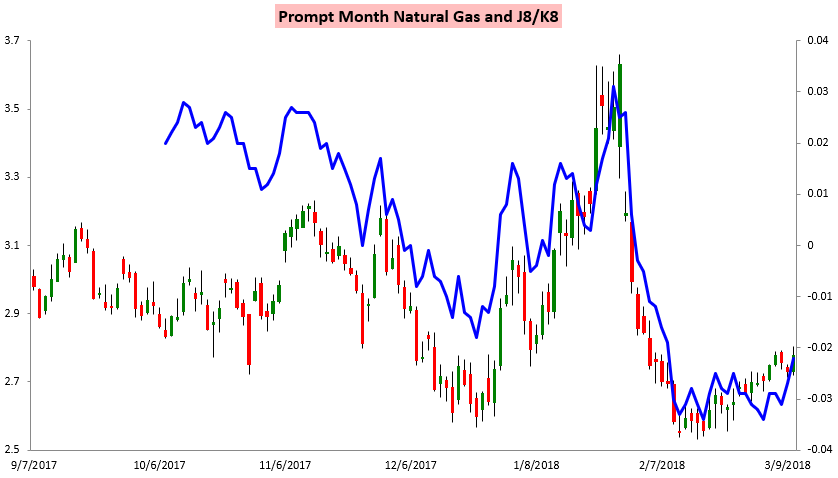

Seen another way, increased weather-driven demand clearly moved out the April/May J/K spread, which hit its highest level in over a month.

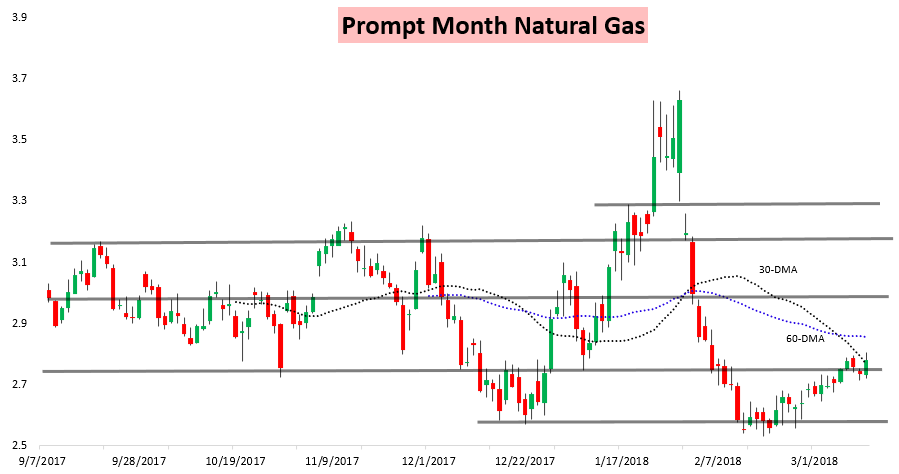

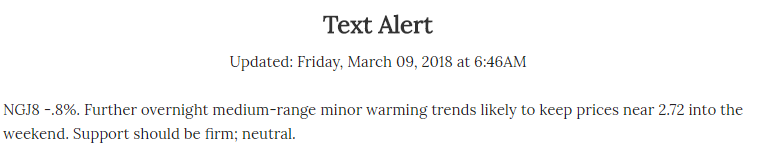

This fit with our expectations, and early this morning in our Early Morning Text Message alert we warned clients that $2.8-$2.82 resistance was likely to get tested on these weekend changes.

Sure enough prices rose right up into that resistance level, pulling back just slightly through the afternoon. Yet when looking out even further along the natural gas strip we can see how front-led the rally was, with later contracts not participating much at all today.

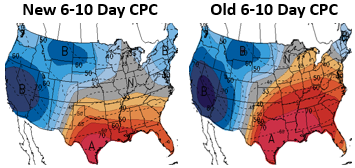

The Climate Prediction Center picked up on these weekend and overnight cold trends as well with a far colder 6-10 Day outlook than they had yesterday.

Though March tends not to bring nearly the type of heating demand that January and February can bring, it still can make a sizable dent in storage levels, and today it clearly drove prices. Meanwhile, traders will continue to keep an eye on storage across the Pacific region, which is the one EIA region where storage levels are outside the 5-year range. We broke this down for subscribers today in our Natural Gas Weekly Update, where we take a close look at all aspects of the natural gas market from balance and storage levels to strip performance, technical movement, and of course current weather forecasts and expected forecast trends.

Leave A Comment