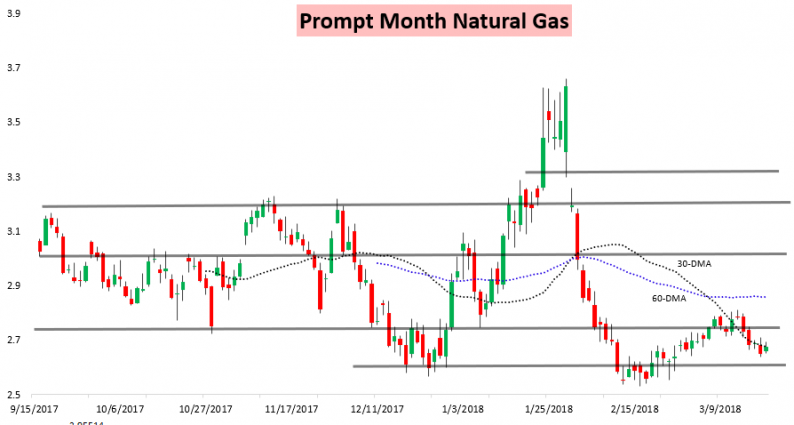

After a day of selling yesterday, the entire natural gas strip recovered today with the prompt month contract bouncing a bit less than a percent.

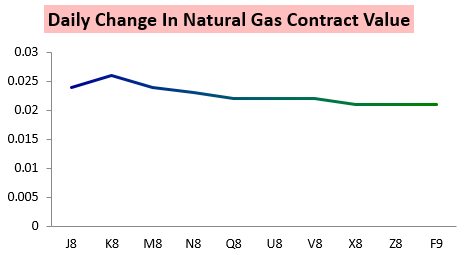

Gains from the October 2018 through the March 2019 contracts were decent as well, coming close to canceling out losses from yesterday.

The winner on the day ended up being the May contract, which was the primary loser yesterday.

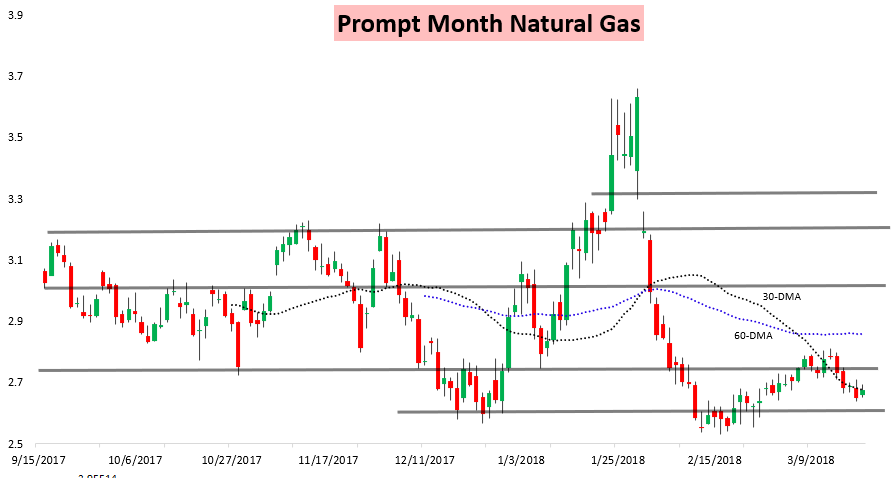

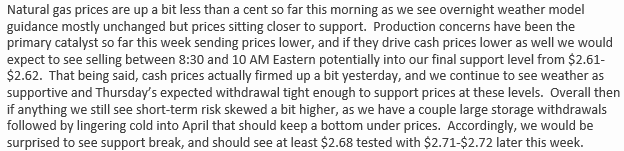

This bounce fit in perfectly with our expectations, as this morning we noted that we saw short-term risk skewed upwards and expected $2.68 to be tested today, which it was just before 11 AM Eastern.

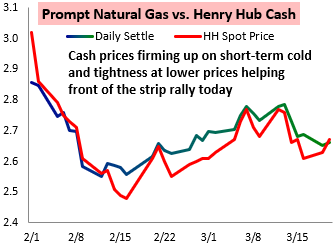

In our intraday Note of the Day today we broke down how a bump in cash prices today appeared to be helping prices recover with the prompt month April contract initially leading.

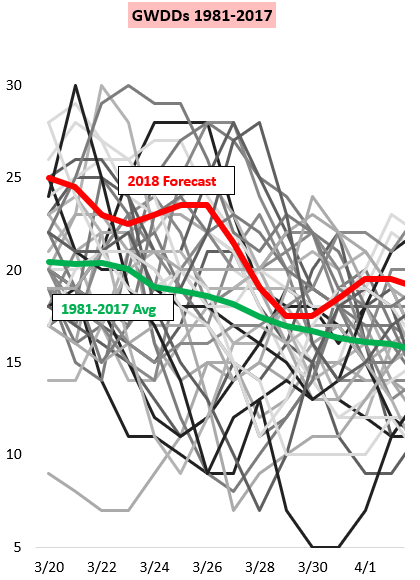

It helped as well that in our Morning Update we continued to expect impressive GWDDs over the next couple of weeks.

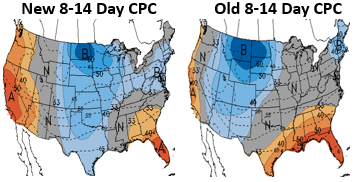

The latest Climate Prediction Center forecast for the 8-14 Day time period showed a slight tick up in cold risks accordingly.

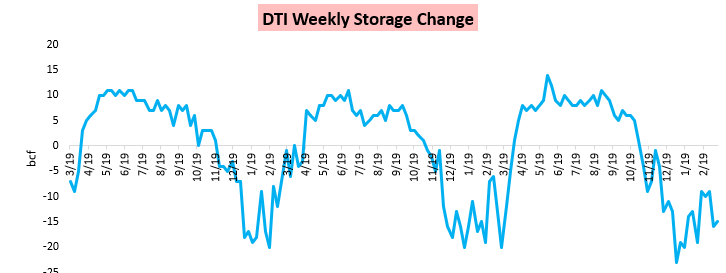

As we move into the middle of the week, however, more attention will turn to Thursday’s EIA print to see if it will confirm or repudiate last week’s slightly bearish miss. Dominion reported a withdrawal that was just a bcf smaller than the week prior already, indicating that at least across the East Region we should see a similar to very slightly smaller withdrawal reported.

Today we published our Seasonal Trader Report for subscribers, updating our 5-month GWDD forecast and looking along the natural gas strip to see how weather over the next few months was likely to influence prices. We highlighted high confidence parts of our spring and early summer forecast, providing ideas for how to play these forecasts using options or spreads.

Leave A Comment