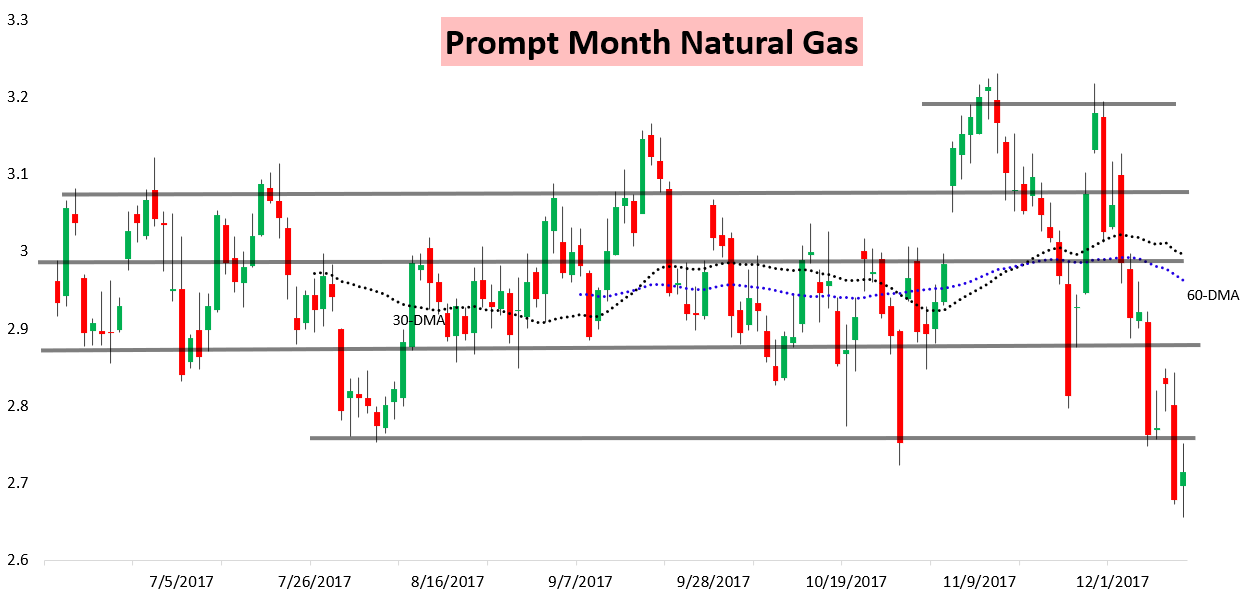

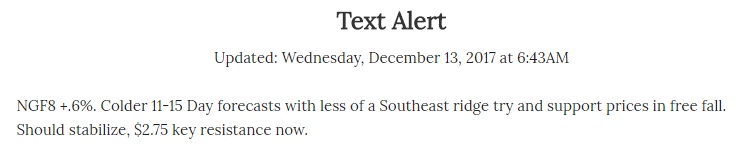

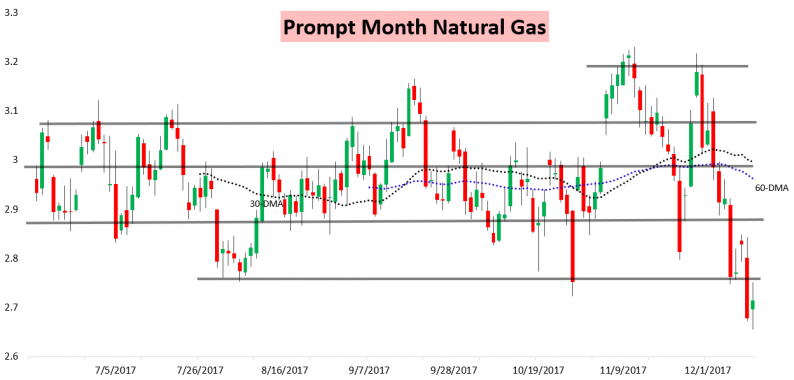

Natural gas prices attempted to decline further mid-morning, trying to reverse from overnight buying on a few colder weather models. However, prices quickly reversed off this selling for the first time in awhile, and a bullish run of American modeling guidance pulled prices right into resistance at $2.75, which they then gradually pulled back from through the rest of the day.

This $2.75 resistance level was exactly the level we were watching this morning when we warned our subscribers just before 7 AM in our Morning Text Message that model guidance had trended more supportive overnight.

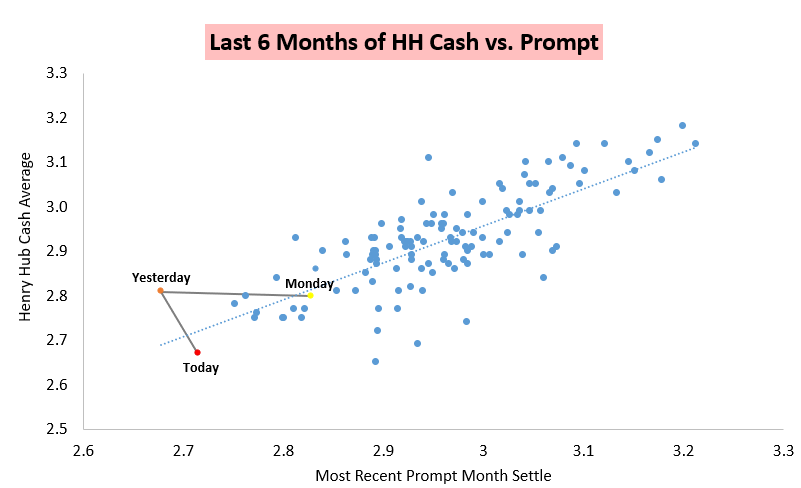

Prices did stabilize eventually, and test that exact resistance level, but were unable to break out higher. Weak cash prices certainly did not help.

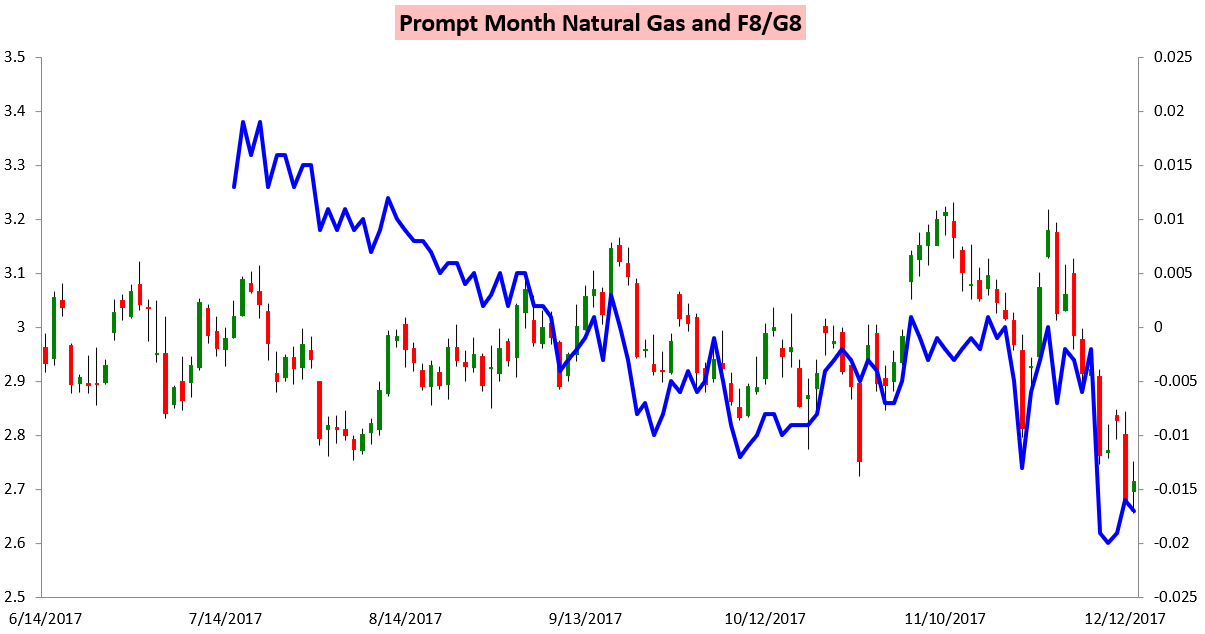

Volatile model guidance also proved to be a problem, as European modeling guidance trended back warmer this afternoon after some colder runs overnight. The result was that even though the January/February F/G spread had been gaining ground all day, it actually settled a couple ticks down.

This is one of the spreads we watch both daily and intraday, using it to alert clients what we see as a major driver of natural gas price action that day. As an example, we identified mid-day yesterday in our Note of the Day that balance would likely continue driving natural gas prices lower, but we similarly forecast that colder trends in weather model guidance would be the one thing that could help support the natural gas market.

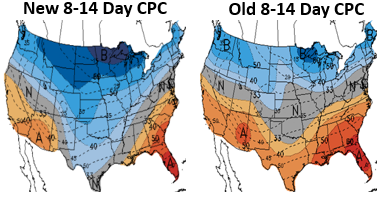

Sure enough, those colder trends came overnight, and they were the one thing that was able to try and save a natural gas market that is otherwise in significant decline. The Climate Prediction Center even picked up on them in their afternoon update today, where they decreased warm risks in the Southeast in line with our forecast yesterday.

Yet the natural gas market is still searching for balance, as later contracts continue to weigh on the front and we have seen some major losses. As we shared earlier on Twitter, our Morning Update showed how even later 2018 natural gas contracts are at 6-month lows following heavy selling.

Leave A Comment