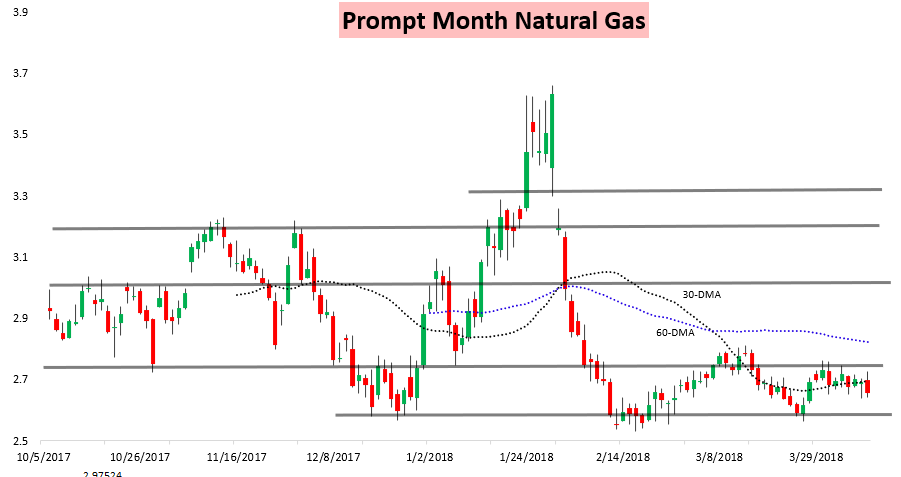

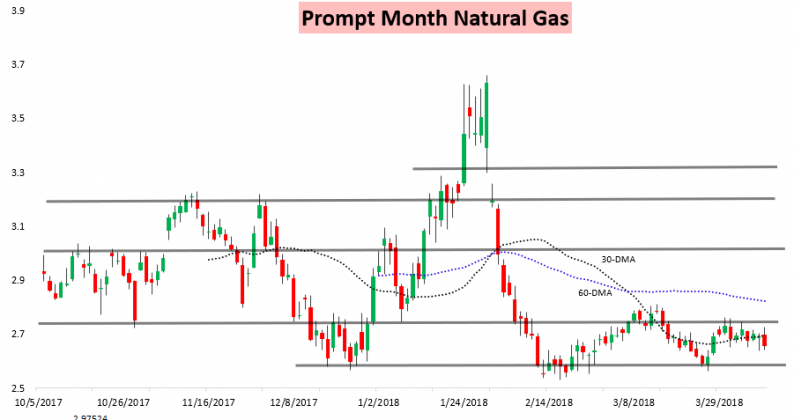

Natural gas prices ground into the lower end of their recent trading range today, with the May contract settling down a bit less than 1.5% on the day.

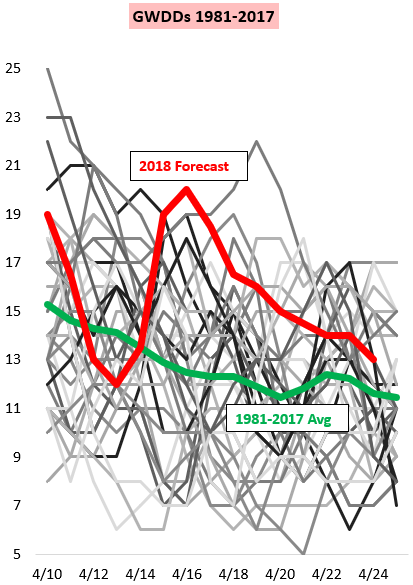

This came even as we saw GWDD forecasts tick up slightly overnight, and medium-range GWDDs may even briefly set a new record going back to 1981 (from our Morning Update).

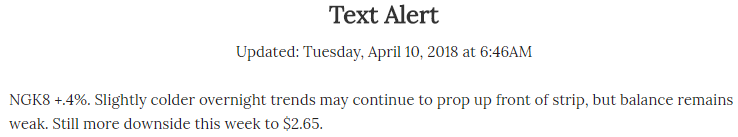

Yet despite these bullish weather forecasts, our subscribers were prepared for the re-test of $2.65 support today. Our Morning Text Message Alert weighed these recent cold trends against other dynamics in the natural gas market to correctly predict the reversal lower in prices.

Our Morning Update then maintained our “Slightly Bearish” market sentiment and called for a re-test of $2.65 even with prices up .8% on the day.

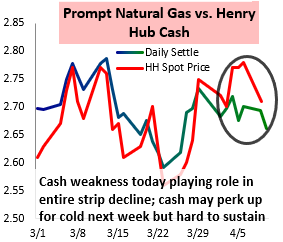

Part of the decline today appeared to be related to weaker cash prices again, with our intraday Note of the Day to clients alerting that the timing and spread action of the heavy morning selling made it appear cash-related.

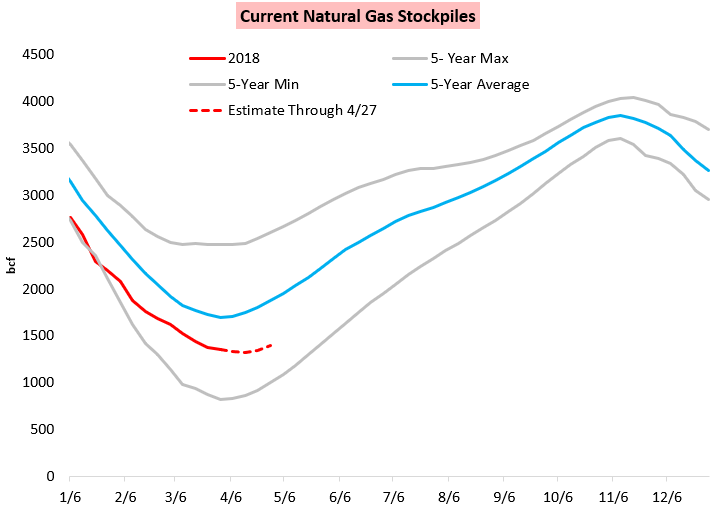

The result is a natural gas market that continues to shake off expectations of both a delayed and very slow start to injection season.

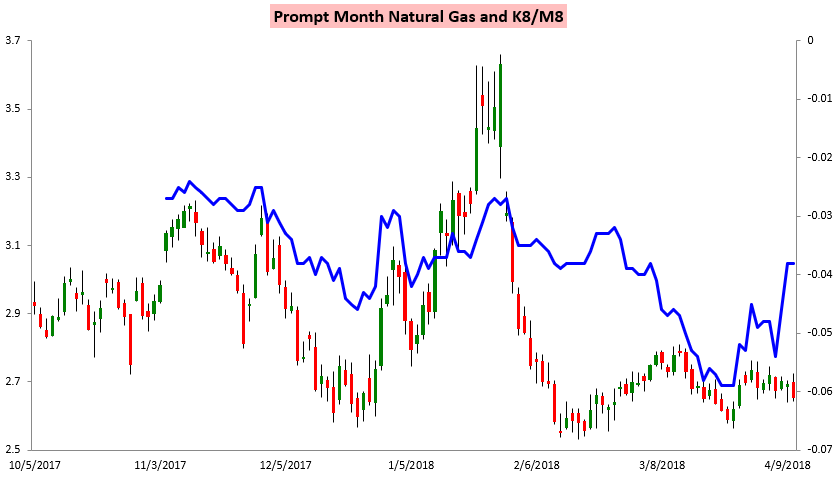

Yet along the strip we can still see the role of weather; K/M was flat on the day and remains significantly up the last few trading days despite prices all along the front of the strip being solidly lower.

Leave A Comment