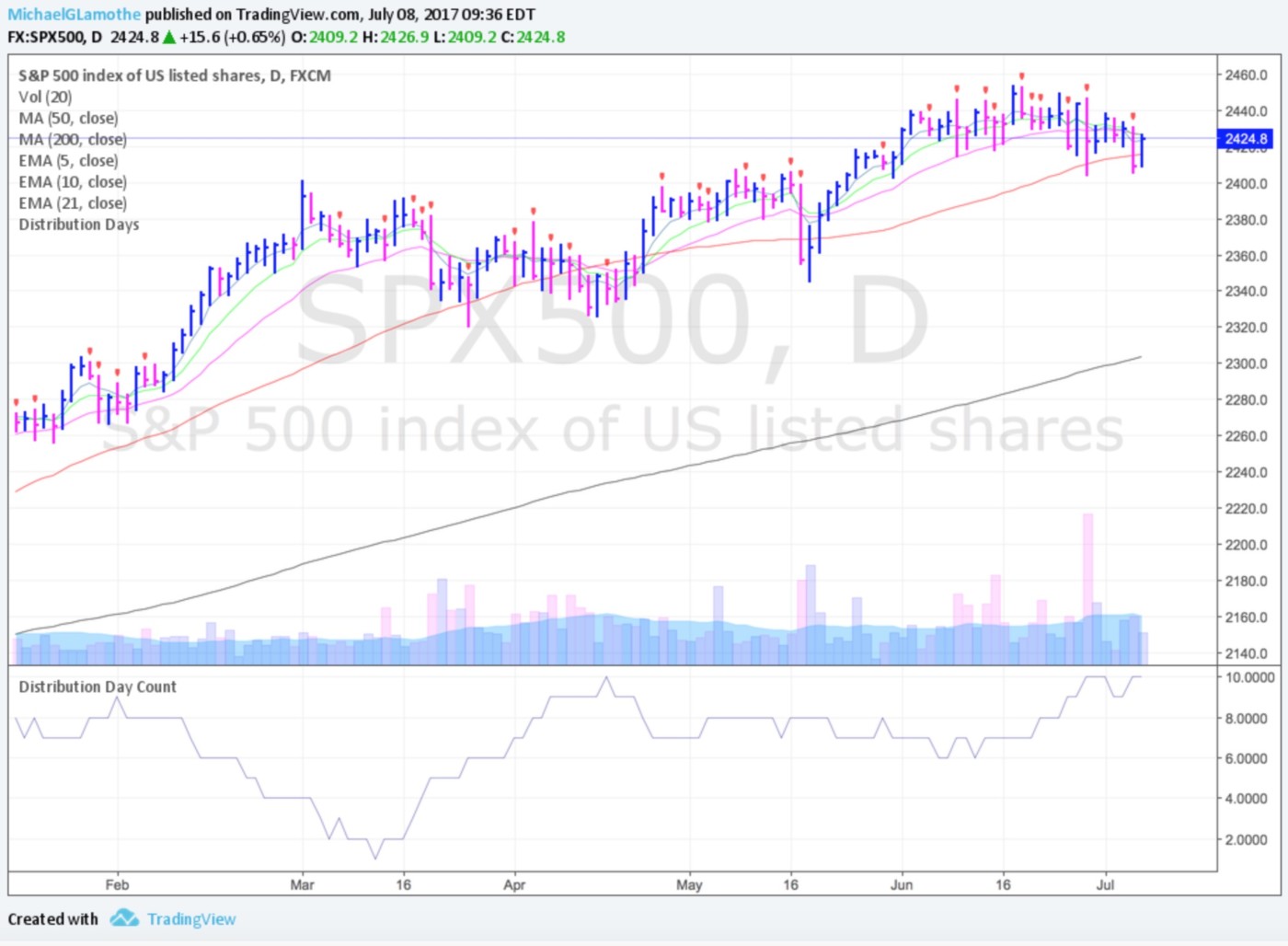

Stocks end mostly higher on the first week of the third quarter. Stepping back, the market remains split. Tech stocks remain under pressure while the Dow Industrials, S&P 500 and Russell 2000 all closed above their respective 50 DMA lines. The bulls showed up on Friday and defended the 50 DMA line for the S&P 500 which is a near-term positive.

Presently, the market is simply pulling back to digest the recent and very strong post-election rally. At this point, the pullback remains relatively mild/healthy. One or two good up days can easily set the market up for another leg higher. However, if the selling continues and the recent lows are breached, lower prices will likely follow.

I do want to note that the Nasdaq is sending mixed signals. On one hand, it is tracing out a somewhat bearish head and shoulders top pattern and it is also tracing out a somewhat bullish double bottom continuation pattern. Until we see more heavy selling coupled with more technical damage, odds favor we still head higher from here.

One more thing… the big macro catalyst that we have to deal with in the second half of 2017 (and beyond) is a slightly more hawkish environment from global central banks.The era of ultra-easy money is behind us (until the next crisis hits). On a shorter to more intermediate term basis, the next big catalyst ahead of us is earnings season.

A Closer Look at What Happened Last Week…

Mon-Wed Action:

Stocks rallied nicely on Monday as the market closed early ahead of the July 4th holiday. History tells us that July 3rd tends to have a strong upward bias. Since the 1920’s, the market has been positive nearly 73% of the time.

Elsewhere, economic data was mixed. The IHS Markit U.S. Manufacturing PMI index for June, slid to 52.0 from 52.7 in May. The ISM manufacturing index for June, rose to 57.8 from 54.9 in May. Monthly auto sales leveled off which sent a slew of auto-repair stocks lower.

Leave A Comment