This past week, the Dow crested 23000 sending the networks into a “tizzy.” It took about 5-minutes of crossing that magical “round number,” before questions raised of how long before the markets cross 24,000, and 25,000.

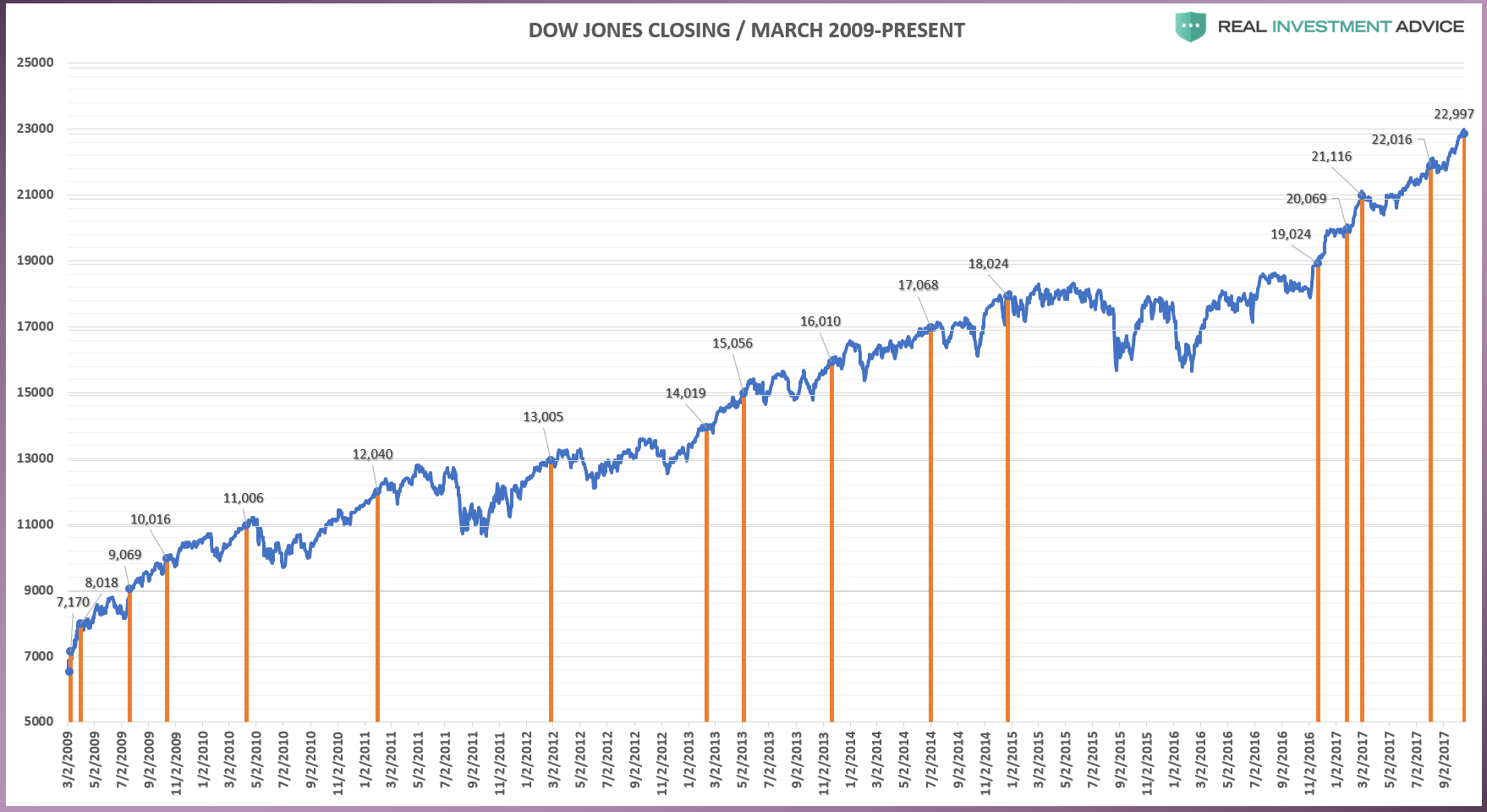

The chart below shows the 1000-point milestones of the Dow going back to 2009. After a long break between 18,000 and 19,000 in 2015 through the election in 2016, the Dow has surged higher ticking off 4-more milestones in less than a year.

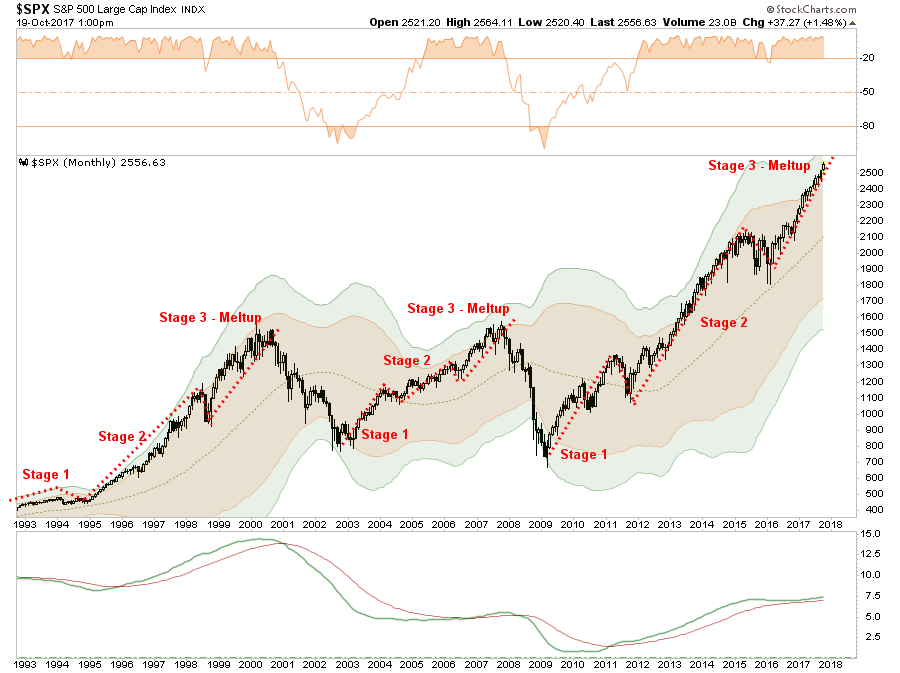

As I have shown previously, these late stage “melt-ups” are not uncommon. In fact, as shown below, it is something witnessed prior to every market peak previously.

As I stated just recently:

“This past weekend, I discussed what appears to be the markets ongoing melt-up toward its inevitable conclusion. Of course, that move is supported by the last of the ‘holdouts’ that finally capitulate and take the plunge back into a market that ‘can seemingly never go down.’ But therein lies the danger.

‘However, it should be noted that despite the ‘hope’ of fiscal support for the markets, longer-term conditions are currently present that have led to rather sharp market reversions in the past. Regardless, the market is currently ignoring such realities as the belief ‘this time is different’ has become overwhelming pervasive.’”

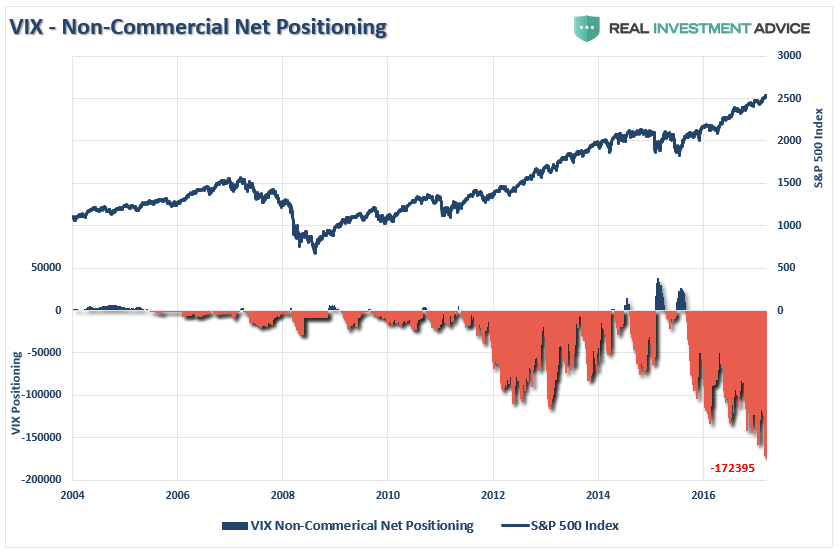

With volatility crushed, and record short positions on the VIX, there will likely be an event at some point that leads to a massive reversal in the assessment of “risk” and an unwinding of the market.

However, such is not the case currently as even “small dips” are met with eager buyers which continues to reinforce the very dangerous lack of fear.

Leave A Comment