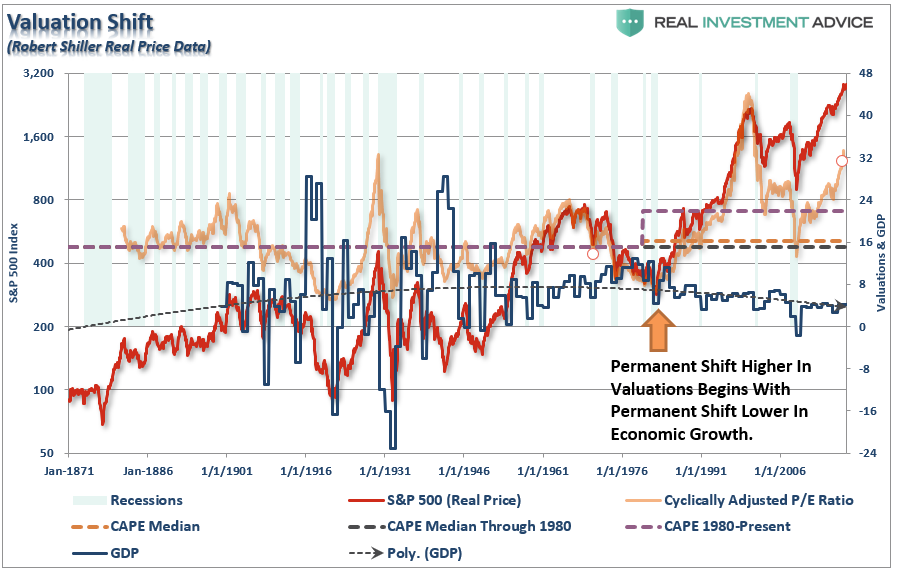

One of the ongoing thesis behind a continuation of a bull market from current valuation levels is that there has been a permanent shift higher in valuations due to changes in accounting rules, propensity for share buybacks, and a greater adoption by the public of investing (aka ETF’s).

This apparent shift to valuations is shown in the chart below.

There are two important things to consider with respect to the chart above.

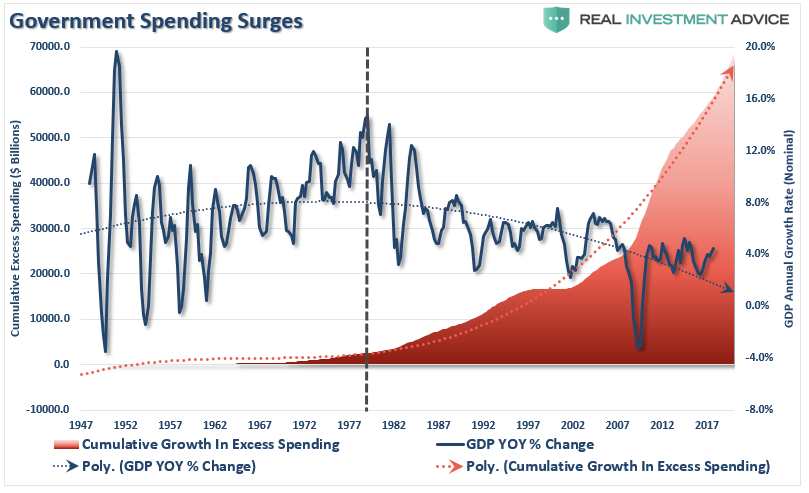

The chart below tracks the cumulative increase in “excess” Government spending above revenue collections. Notice the point at which nominal GDP growth stopped rising. It is also the point that valuations shifted higher.

Given that economic leverage (corporate, consumer, financial, and Government debt) is at all-time records, and rising, the ability to create stronger, sustainable, economic growth (which would lead to higher rates of inflation) remains little more than a hopeful goal.

The issue with the idea that valuations have had a permanent shift upward is that the assumption is based on a market anomaly form 1990-2000 which temporarily skewed valuations above the long-term medians. However, economic growth set to remain near 2% over the long-term, the average valuation ranges will most likely trend lower in the future.

Ed Easterling at Crestmont Research made a great point recently in this regard:

“However, as real economic growth significantly declined over the past two decades, it triggered a series of adjustments that represent the forces behind The Big Shift. Most importantly, the downshift in real economic growth disrupted the financial relationship of profits, future growth, and market value.

Slower growth drives P/E downward for similar reasons that it drives EPS upward.”

Leave A Comment